Free South Dakota Transfer-on-Death Deed Document

The South Dakota Transfer-on-Death Deed (TODD) form serves as a valuable tool for property owners looking to streamline the transfer of real estate upon their passing. This legal document allows individuals to designate one or more beneficiaries who will automatically inherit the property without the need for probate. By filling out this form, property owners can maintain control of their assets during their lifetime while ensuring a smooth transition for their heirs. The TODD form requires specific information, including the property description and the names of the beneficiaries, to be valid. Importantly, it does not take effect until the owner's death, meaning that the property remains under the owner's control until that time. South Dakota law provides guidelines on how to properly execute and record the deed, making it essential for individuals to follow these steps to avoid complications. Understanding the nuances of the Transfer-on-Death Deed can help individuals make informed decisions about their estate planning and provide peace of mind for both themselves and their loved ones.

Fill out Other Popular Forms for South Dakota

South Dakota Power of Attorney Form - This legal document is a crucial tool for managing personal or business affairs.

When forming a Limited Liability Company (LLC), it's essential to have a comprehensive Operating Agreement to delineate the governance structure and operational guidelines effectively. This document helps avoid ambiguities by clarifying the rights and responsibilities of each member and addressing financial and functional decision-making processes. For those looking to draft an Operating Agreement, resources like TopTemplates.info can be invaluable in providing templates and guidance.

Dmv Registration Sticker - This Bill of Sale can streamline the transfer process at DMV.

South Dakota Quit Claim Deed Form - The form is suitable for informal arrangements between parties.

File Specifics

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | South Dakota Codified Laws, Chapter 43-25B governs the Transfer-on-Death Deed. |

| Eligibility | Any individual who owns real estate in South Dakota can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can designate one or more beneficiaries in the deed. |

| Revocation | The deed can be revoked at any time by the property owner before their death. |

| Execution Requirements | The deed must be signed by the property owner and notarized to be valid. |

| Recording | The Transfer-on-Death Deed must be recorded in the county where the property is located to take effect. |

| Tax Implications | There are generally no immediate tax implications for the transfer, but beneficiaries should consult a tax advisor. |

| Limitations | This deed cannot be used for transferring personal property or for properties held in joint tenancy. |

| Effectiveness | The transfer takes effect automatically upon the death of the property owner, bypassing probate. |

Guidelines on How to Fill Out South Dakota Transfer-on-Death Deed

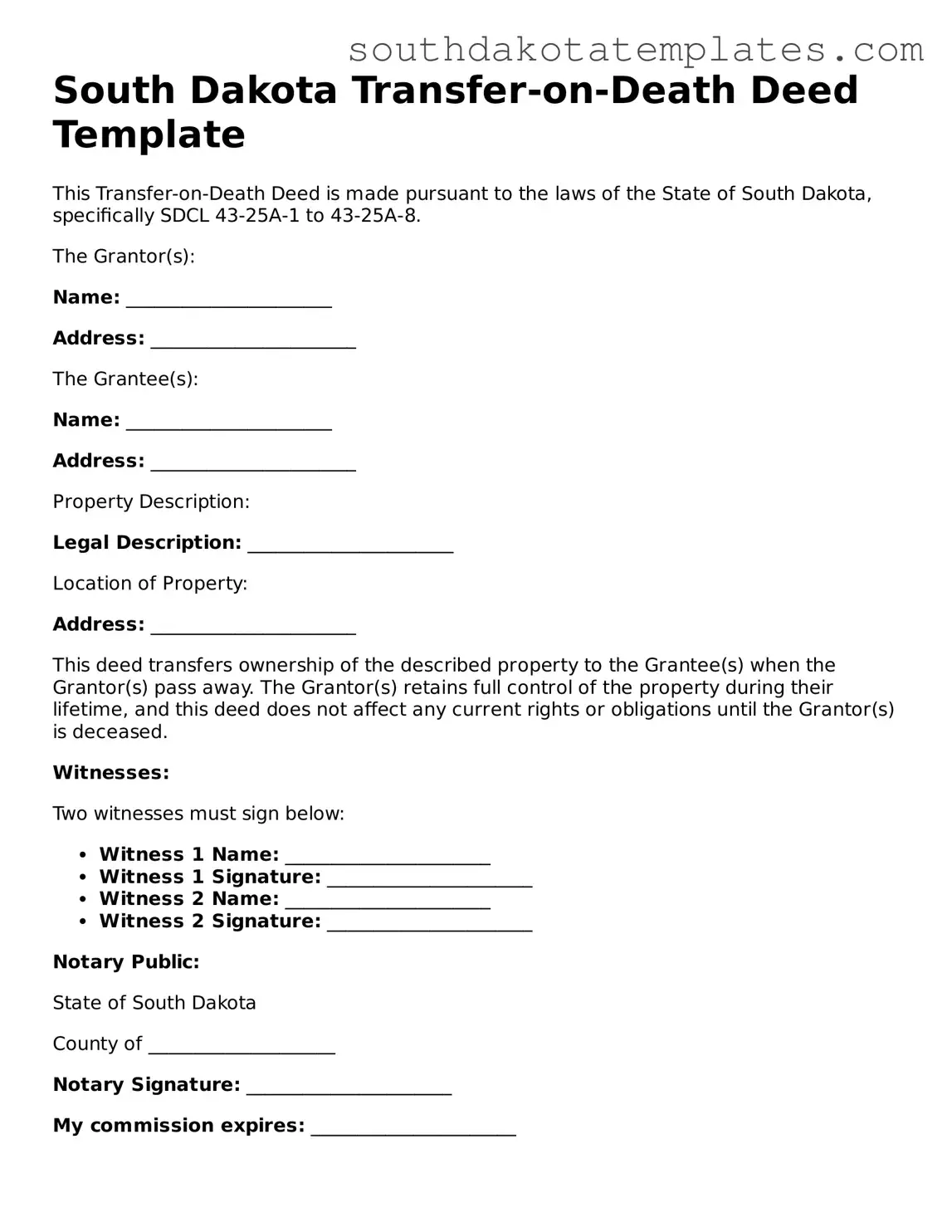

Filling out the South Dakota Transfer-on-Death Deed form is a straightforward process. Once completed, this form allows you to designate a beneficiary for your property, ensuring a smooth transfer upon your passing. Follow these steps carefully to ensure that all necessary information is included.

- Begin by obtaining the South Dakota Transfer-on-Death Deed form. You can find it online or request a copy from your local county register of deeds.

- At the top of the form, fill in the names and addresses of the current property owners. Ensure that all names are spelled correctly.

- Provide a complete legal description of the property. This includes the address, parcel number, and any other identifying details. You can usually find this information on your property tax statement or deed.

- Next, enter the name of the beneficiary or beneficiaries. List them in the order you wish them to inherit the property.

- Include the addresses of all beneficiaries. This is important for future correspondence and legal notifications.

- Sign and date the form in the designated area. Make sure to do this in the presence of a notary public, as notarization is required.

- After notarization, file the completed form with the county register of deeds where the property is located. There may be a filing fee, so check with the office for the exact amount.

Once you have submitted the form, keep a copy for your records. It’s a good idea to inform your beneficiaries about the deed and where to find it. This will help avoid any confusion in the future.

Misconceptions

Many individuals hold misconceptions about the South Dakota Transfer-on-Death Deed form. Understanding the facts can help clarify its purpose and benefits. Here are nine common misconceptions:

- 1. A Transfer-on-Death Deed is the same as a will. A Transfer-on-Death Deed specifically transfers property upon death, while a will addresses the distribution of all assets and may include guardianship provisions.

- 2. The property must be probated after death. Properties transferred via a Transfer-on-Death Deed do not go through probate, simplifying the transfer process for heirs.

- 3. Only real estate can be transferred. While primarily used for real estate, the deed does not cover personal property. Separate arrangements are needed for personal assets.

- 4. The deed is revocable only before death. The Transfer-on-Death Deed can be revoked or amended at any time before the property owner’s death.

- 5. Heirs automatically inherit the property without any action. Heirs must still file the necessary documentation with the county register of deeds to complete the transfer.

- 6. The deed can only be created by an attorney. While legal assistance is beneficial, individuals can create a Transfer-on-Death Deed on their own, provided they follow the state’s requirements.

- 7. It is only for married couples. Any individual can use a Transfer-on-Death Deed to designate beneficiaries, regardless of marital status.

- 8. The deed transfers ownership during the owner's lifetime. The Transfer-on-Death Deed does not transfer ownership until the property owner passes away, allowing the owner to retain full control while alive.

- 9. Beneficiaries must be family members. Property owners can name anyone as a beneficiary, including friends or charities, providing flexibility in estate planning.

Understanding these misconceptions is crucial for effective estate planning in South Dakota. The Transfer-on-Death Deed can be a valuable tool when used correctly.

Documents used along the form

The South Dakota Transfer-on-Death Deed form is a useful document for transferring property upon the owner's death without going through probate. Several other forms and documents may accompany it to ensure a smooth process. Here is a list of some commonly used documents related to the Transfer-on-Death Deed.

- Will: A legal document that outlines how a person's assets should be distributed after their death. It can include specific bequests and appoint an executor to manage the estate.

- Affidavit of Death: This document provides proof of a person's death. It may be required to finalize the transfer of property and can help in clearing up any ownership issues.

- Title Transfer Form: This form is used to officially transfer the title of a property from one owner to another. It ensures that the new owner is recognized as the legal owner of the property.

- Last Will and Testament Form: When preparing for the future, utilize our necessary Florida Last Will and Testament document to clarify your wishes and safeguard your estate.

- Property Deed: A legal document that conveys ownership of real estate. It includes details about the property and the parties involved in the transfer.

- Beneficiary Designation Form: This form allows individuals to designate beneficiaries for specific assets, such as bank accounts or retirement plans, which can complement the Transfer-on-Death Deed.

- Living Trust: A legal arrangement that allows a person to place their assets into a trust during their lifetime. It can help avoid probate and facilitate the transfer of assets upon death.

These documents can help clarify intentions and streamline the transfer process. It is advisable to consult with a professional to ensure all necessary forms are completed correctly.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details, such as the property address or the names of the beneficiaries, can render the deed invalid.

-

Incorrect Signatures: Not obtaining the required signatures from all parties involved, including the property owner and witnesses, can lead to complications in the transfer process.

-

Not Following Notarization Requirements: Some individuals overlook the need for notarization, which is essential for the deed to be legally binding.

-

Failure to Record the Deed: After completing the form, neglecting to file it with the appropriate county office may result in the deed not being recognized.

-

Choosing Ineligible Beneficiaries: Designating individuals or entities that do not qualify under South Dakota law can invalidate the transfer.

-

Omitting the Legal Description: Not including a clear legal description of the property can create confusion and potential disputes over ownership.

-

Ignoring State-Specific Requirements: Failing to adhere to South Dakota's specific guidelines for Transfer-on-Death Deeds can lead to legal challenges.

Key takeaways

When dealing with the South Dakota Transfer-on-Death Deed form, there are several important points to consider. Here are key takeaways to guide you through the process:

- Understand that a Transfer-on-Death Deed allows you to transfer real estate to beneficiaries without going through probate.

- The form must be completed and signed by the property owner while they are alive and competent.

- It is crucial to include a legal description of the property to avoid confusion or disputes later.

- Make sure to name the beneficiaries clearly. Ambiguities can lead to complications in the future.

- The deed must be recorded with the county register of deeds to be effective. Failure to do so may invalidate the transfer.

- Beneficiaries can decline the property if they choose, which can help avoid unwanted tax implications.

- Keep a copy of the recorded deed in a safe place, and inform your beneficiaries about its existence.

- Consulting with an attorney can provide clarity and ensure that all legal requirements are met.