South Dakota From 21C Form

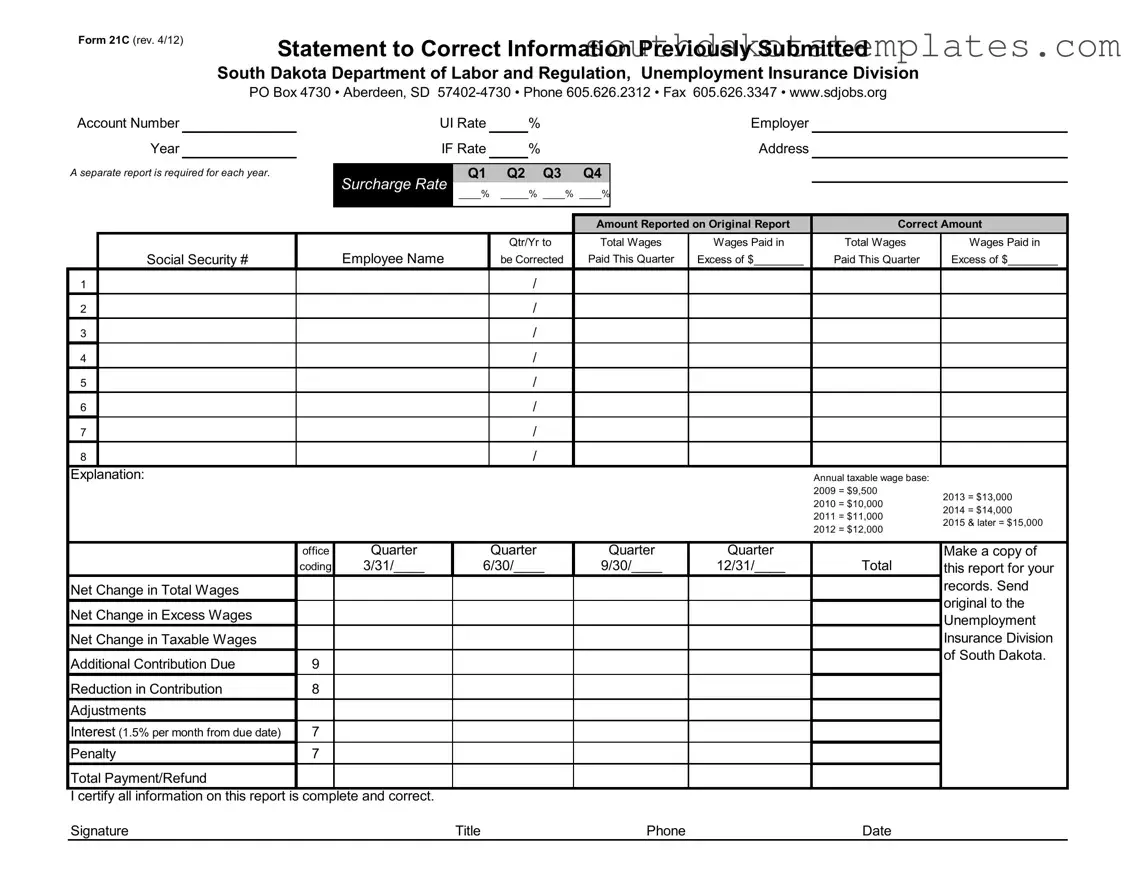

The South Dakota Form 21C is a critical document for employers needing to correct previously submitted unemployment insurance information. This form, officially titled "Statement to Correct Information Previously Submitted," allows employers to amend inaccuracies in wage reporting for their employees. It is essential to submit a separate report for each year that requires correction. The form captures various details, including the employer's account number, UI rate, and the specific year in question. Employers must provide corrected amounts for total wages and wages paid, along with explanations for any discrepancies. Additionally, the form includes sections for reporting excess wages and taxable wage bases, which vary by year. To ensure compliance, it is vital to complete the form accurately and submit it to the South Dakota Department of Labor and Regulation's Unemployment Insurance Division, with a copy retained for records. Timely submission is important, as adjustments may incur penalties or interest if not addressed promptly.

Check out Other Forms

South Dakota Unemployment Employer Registration - The form requires a signature from an owner, partner, or authorized official of the business.

For those considering the importance of estate planning, utilizing a Last Will and Testament form is crucial, as it not only provides clarity on asset distribution but also appoints an executor responsible for fulfilling final wishes. Resources such as smarttemplates.net offer valuable templates to help guide individuals through this essential process.

South Dakota Dmv - It is critical for pesticide application compliance and regulatory standards.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The South Dakota Form 21C is used to correct previously submitted unemployment insurance information. |

| Governing Law | This form is governed by South Dakota Codified Laws, specifically Chapter 61-1. |

| Submission Requirements | A separate report must be completed for each year that requires correction. |

| Taxable Wage Base | The annual taxable wage base for 2015 and later is $15,000. |

| Contact Information | For assistance, contact the South Dakota Department of Labor and Regulation at 605.626.2312. |

Guidelines on How to Fill Out South Dakota From 21C

Filling out the South Dakota Form 21C is essential for correcting previously submitted information related to unemployment insurance. It’s important to ensure accuracy to avoid any potential issues with your unemployment insurance account. Follow these steps carefully to complete the form correctly.

- Gather your information. You will need your account number, the employer year, and details about wages reported on the original report.

- Fill in your account number. This is usually found on previous correspondence from the South Dakota Department of Labor and Regulation.

- Enter the employer year. Specify the year for which you are correcting the information.

- Report the amounts. In the section for "Amount Reported on Original Report," write the total wages that were originally reported.

- Provide the correct amounts. In the "Correct Amount" section, enter the accurate total wages that should be reported.

- Complete the quarterly breakdown. For each quarter (Q1, Q2, Q3, Q4), fill in the wages paid during that quarter, including any excess amounts.

- List employee names. Include the names of employees associated with the reported wages in the designated area.

- Write an explanation. If necessary, provide a brief explanation for the corrections you are making in the space provided.

- Calculate totals. Add up the total changes in wages, excess wages, and any other adjustments that apply to your situation.

- Sign and date the form. At the bottom of the form, sign your name, include your title, phone number, and the date.

- Make a copy. Before submitting, make a copy of the completed form for your records.

- Submit the form. Send the original form to the South Dakota Department of Labor and Regulation, Unemployment Insurance Division.

Completing this form accurately is crucial to ensure your unemployment insurance records are correct. Double-check your entries and submit the form as soon as possible to avoid any penalties or complications.

Misconceptions

Understanding the South Dakota Form 21C can be challenging due to various misconceptions. Below are five common misunderstandings about this form:

- Misconception 1: The form is only for large employers.

- Misconception 2: The form is only necessary if there is a significant error.

- Misconception 3: Submitting the form is optional.

- Misconception 4: The form can be submitted at any time without consequences.

- Misconception 5: The form does not require a signature.

This is not true. Any employer who needs to correct information previously submitted regarding unemployment insurance can use Form 21C, regardless of the size of their business.

Employers must submit the form for any corrections, regardless of the magnitude of the error. Even minor discrepancies should be addressed to ensure accurate reporting.

Submitting Form 21C is mandatory when there are corrections to previously reported information. Failure to submit the form can lead to penalties and inaccuracies in unemployment insurance records.

There are deadlines associated with submitting Form 21C. Timely submission is crucial to avoid interest charges and penalties that may arise from late corrections.

A signature is required on Form 21C to certify that the information provided is complete and correct. This ensures accountability and compliance with reporting regulations.

Documents used along the form

When dealing with the South Dakota Form 21C, there are several other forms and documents that may also come into play. Understanding these documents can help ensure that everything is handled correctly and efficiently. Below is a list of commonly used forms alongside the Form 21C, each serving a unique purpose in the process of reporting and correcting information related to unemployment insurance.

- Form 21A: This form is used for reporting wages and employment information for each employee. It provides the foundational data that may need to be corrected later on.

- Form 21B: This is a summary of quarterly wages paid to employees. Employers submit this form to report total wages for the quarter, which is essential for calculating unemployment insurance contributions.

- Form 21D: If an employer needs to dispute a determination made by the Department of Labor, this form is used to file an appeal. It outlines the reasons for the appeal and any supporting evidence.

- Form 21E: This document is the Employer's Annual Report. It summarizes all the quarterly reports submitted throughout the year and is crucial for finalizing unemployment insurance contributions.

- Form 21F: Employers use this form to request a refund for overpaid unemployment insurance contributions. It requires detailed information about the payments made and the reasons for the refund request.

- California Boat Bill of Sale: For boat transactions, parties must complete a https://toptemplates.info/bill-of-sale/boat-bill-of-sale/california-boat-bill-of-sale, establishing legal ownership transfer and serving as a comprehensive proof of purchase.

- Form 21G: This form is used to report any changes in ownership or business structure. Such changes can affect unemployment insurance rates and obligations.

- Form 21H: This is a notice of separation from employment. Employers must complete this form when an employee leaves the company, which is necessary for determining eligibility for unemployment benefits.

- Form 21I: This document is for reporting any changes in an employee’s wages or hours worked. It helps maintain accurate records for unemployment insurance calculations.

- Form 21J: This form is utilized to report any additional contributions due. It is important for ensuring that all financial obligations related to unemployment insurance are met.

Being familiar with these forms can simplify the process of managing unemployment insurance matters in South Dakota. Each document plays a crucial role in ensuring compliance and accuracy in reporting. By keeping everything organized and up to date, employers can avoid potential issues and ensure a smoother experience with the Department of Labor and Regulation.

Common mistakes

-

Neglecting to use the correct form version: Always ensure you are using the latest version of Form 21C. Using an outdated form can lead to processing delays or rejections.

-

Failing to provide complete information: Each section of the form must be filled out completely. Missing details can cause confusion and may result in the form being returned.

-

Incorrectly calculating wages: Double-check your calculations for total wages and excess wages. Errors in these figures can lead to incorrect contributions and potential penalties.

-

Not including all required signatures: Ensure that the form is signed by an authorized individual. A missing signature can delay processing and may require resubmission.

-

Ignoring the deadline: Submit the form by the specified deadline to avoid late fees or penalties. Mark your calendar to stay organized.

-

Forgetting to keep a copy: Always make a copy of the completed form for your records. This can be crucial for future reference or if any issues arise.

-

Overlooking the explanation section: If you are correcting previous information, provide a clear explanation of the changes. This helps clarify the adjustments made.

-

Not verifying contact information: Ensure that the contact information provided is accurate. This allows the Department of Labor to reach you if there are questions or issues with your submission.

Key takeaways

When filling out and using the South Dakota Form 21C, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are nine key takeaways to consider:

- Separate Reports Required: A distinct Form 21C must be completed for each year that requires corrections.

- Accurate Account Information: Ensure that the account number, employer year, and other identifying details are correctly entered at the top of the form.

- Quarterly Breakdown: The form requires you to report wages for each quarter separately. Make sure to fill in the amounts accurately for Q1, Q2, Q3, and Q4.

- Correct Amounts: Clearly indicate the correct amounts for total wages and wages paid in excess for each employee to avoid any discrepancies.

- Explanation Section: Provide a detailed explanation for the corrections being made. This helps clarify the reasons for the adjustments.

- Annual Taxable Wage Base: Familiarize yourself with the annual taxable wage base for each year, as it can impact the calculations on the form.

- Keep Copies: Always make a copy of the completed form for your records before submitting the original to the Unemployment Insurance Division.

- Timely Submission: Submit the form promptly to avoid penalties and interest charges. Late submissions can incur additional fees.

- Certification: Sign and date the form to certify that all information provided is complete and accurate. This is a crucial step in the process.

By following these guidelines, you can help ensure that your corrections are processed smoothly and efficiently. Take the time to review the form carefully before submission to prevent any potential issues.