South Dakota 55 Form

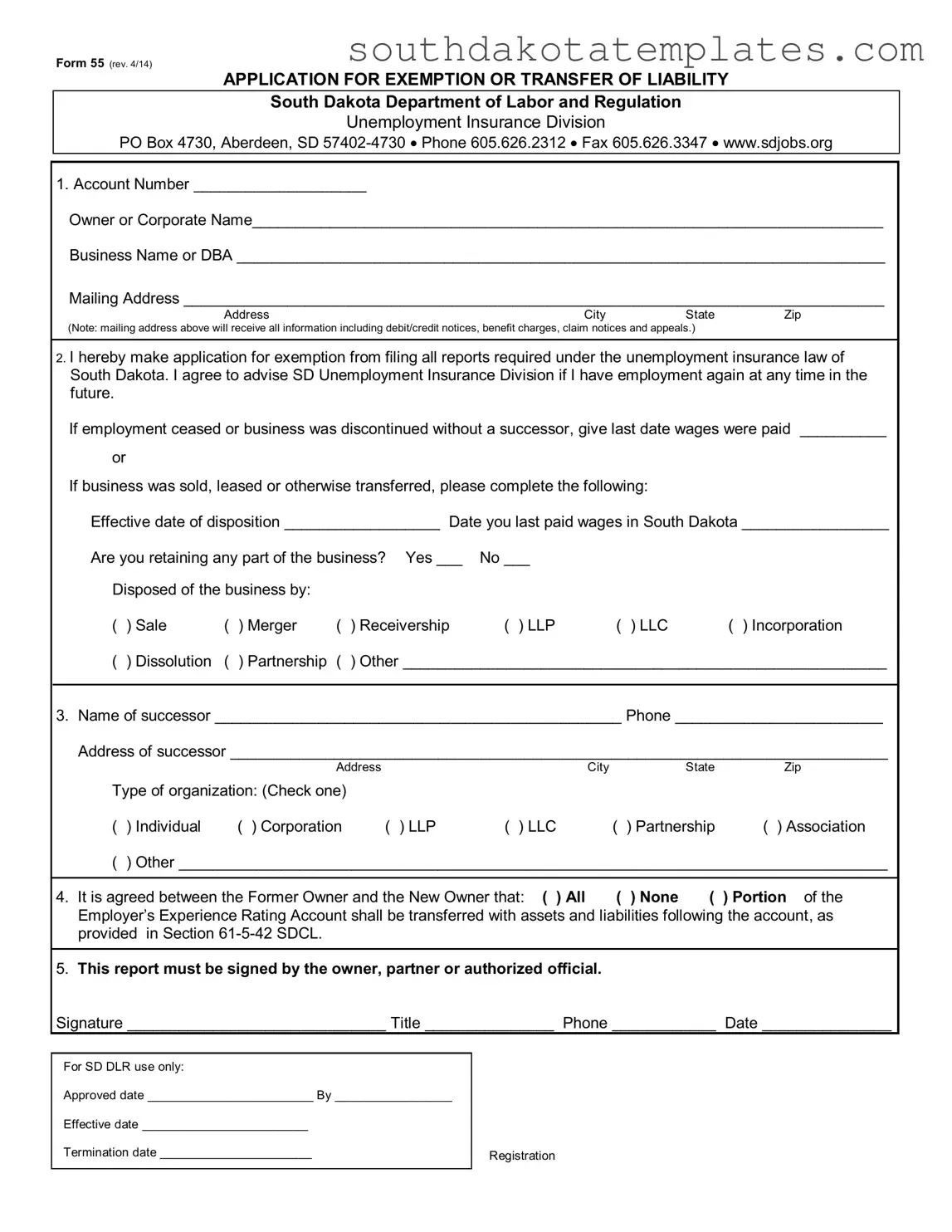

The South Dakota 55 form serves as a crucial tool for businesses navigating the complexities of unemployment insurance in the state. Designed for those seeking exemption from filing reports under South Dakota’s unemployment insurance law, this application is essential for business owners who have ceased operations or transferred ownership. By completing this form, owners can formally notify the South Dakota Department of Labor and Regulation about their employment status, whether they have discontinued their business or sold it to a new owner. The form requires detailed information, including the owner’s account number, business name, and mailing address, ensuring that all correspondence, such as debit or credit notices and benefit charges, reaches the correct location. Additionally, it prompts the former owner to disclose the last date wages were paid and to identify any successor who may be taking over the business. The agreement section allows for the transfer of the employer’s experience rating account, a critical aspect that can affect future unemployment insurance liabilities. This form is not just a bureaucratic requirement; it plays a significant role in managing the responsibilities of business owners and their successors in South Dakota.

Check out Other Forms

South Dakota Dmv - The A 94 A form is a vital part of the agricultural industry in South Dakota.

A New York Lease Agreement form is a legally binding document between a landlord and tenant, outlining the terms and conditions of renting property in New York. This form covers various aspects such as rent amount, payment schedule, and lease duration. Understanding this agreement is crucial for both landlords and tenants to ensure their rights are protected. For more information, you can visit smarttemplates.net/.

File Overview

| Fact Name | Description |

|---|---|

| Purpose | The South Dakota 55 form is used to apply for exemption from filing unemployment insurance reports or to transfer liability for unemployment insurance obligations. |

| Governing Law | This form is governed by the South Dakota Codified Laws, specifically Section 61-5-42, which outlines the transfer of employer experience rating accounts. |

| Eligibility | Businesses that have ceased operations or are transferring ownership may apply for exemption or transfer of liability using this form. |

| Required Information | Applicants must provide their account number, business name, mailing address, and details about the business's status and ownership transfer. |

| Successor Information | The form requires the name and contact information of the successor, ensuring that the new owner is aware of any liabilities being transferred. |

| Signature Requirement | The application must be signed by the owner, partner, or an authorized official, confirming the accuracy of the information provided. |

| Submission Details | Completed forms should be submitted to the South Dakota Department of Labor and Regulation, Unemployment Insurance Division, via mail, phone, or fax. |

Guidelines on How to Fill Out South Dakota 55

Filling out the South Dakota 55 form requires careful attention to detail. This form is essential for those seeking exemption from unemployment insurance reporting or for transferring liability. Be sure to have all necessary information at hand before you begin.

- Locate the Account Number section at the top of the form. Enter your account number in the designated space.

- In the Owner or Corporate Name field, write the full name of the business owner or corporation.

- Next, fill in the Business Name or DBA (Doing Business As) if applicable.

- Complete the Mailing Address section. Include the street address, city, state, and zip code. This address will receive all important notices.

- In section 2, indicate your intention to apply for exemption from unemployment insurance reports. You will also need to state if you have ceased employment or if the business was sold or transferred. Fill in the last date wages were paid if applicable.

- If the business was sold or transferred, provide the Effective date of disposition and the date you last paid wages in South Dakota.

- Indicate whether you are retaining any part of the business by checking Yes or No.

- Select the method of business disposition by checking the appropriate box (e.g., Sale, Merger, etc.).

- In section 3, enter the Name of successor and their Phone number. Fill in the successor's address as well.

- Choose the type of organization for the successor by checking one of the options provided.

- In section 4, indicate the agreement between the former owner and the new owner regarding the transfer of the Employer’s Experience Rating Account. Select from the options given.

- Finally, the form must be signed by the owner, partner, or authorized official. Fill in the Signature, Title, Phone, and Date fields.

After completing the form, review it for accuracy. Once everything is filled out correctly, submit it to the South Dakota Department of Labor and Regulation. Be sure to keep a copy for your records.

Misconceptions

Misconceptions about the South Dakota 55 form can lead to confusion and errors in the application process. Here are ten common misunderstandings:

- Form 55 is only for large businesses. Many believe that only large companies need to file this form. In reality, any business that meets specific criteria can apply for exemption or transfer of liability, regardless of size.

- Filing the form is optional. Some think that submitting Form 55 is merely a suggestion. However, if you qualify for an exemption, filing is necessary to avoid potential penalties.

- Once filed, the exemption is permanent. Many assume that once they receive an exemption, they are exempt forever. This is not true; you must notify the Unemployment Insurance Division if you hire employees again.

- The form can be submitted anytime. Some believe they can file the form at their convenience. However, there are deadlines associated with filing, especially when it involves the sale or transfer of a business.

- Only sole proprietors can use Form 55. A common misconception is that only sole proprietors can apply. In fact, partnerships, corporations, and other business entities can also use this form.

- All liabilities are automatically transferred. Some think that when a business is sold, all liabilities transfer automatically. The form allows for a choice regarding the transfer of the Employer’s Experience Rating Account, which must be clearly indicated.

- The successor must be a corporation. Many believe that only corporations can be successors in business transactions. However, individuals, partnerships, and other types of organizations can also take on this role.

- Only the owner needs to sign the form. Some think that only the business owner’s signature is required. However, if there are partners or authorized officials, their signatures may also be necessary.

- There is no need for a mailing address. Many overlook the importance of providing a mailing address. This address is crucial as it will receive all related notices and information.

- The form is only for unemployment insurance. Some individuals mistakenly believe that the form only pertains to unemployment insurance. In reality, it also involves the transfer of liabilities and experience ratings, which can affect future business operations.

Understanding these misconceptions can help ensure that businesses navigate the application process more effectively and comply with South Dakota's regulations.

Documents used along the form

The South Dakota 55 form is an important document for businesses seeking exemption or transfer of liability under the state's unemployment insurance laws. Alongside this form, several other documents may be required or helpful during the process. Below is a list of commonly used forms and documents that often accompany the South Dakota 55 form.

- Form 56: Request for Reinstatement - This form is used by businesses that wish to reinstate their unemployment insurance account after it has been canceled or suspended. It provides the necessary information to reactivate the account.

- Employer Registration Form - New businesses must complete this form to register for unemployment insurance. It includes details about the business, such as ownership structure and contact information.

- Dog Bill of Sale: This important document facilitates the legal transfer of dog ownership, ensuring a formal record of the transaction. For more information on this form, click here.

- Experience Rating Account Transfer Request - This document is specifically for businesses that want to transfer their unemployment insurance experience rating account to a new owner. It outlines the terms of the transfer and any associated liabilities.

- Final Wage Report - When a business ceases operations, it must submit a final wage report. This document details all wages paid to employees up until the business closure, ensuring compliance with unemployment insurance regulations.

- Notice of Business Discontinuation - This notice informs the South Dakota Department of Labor and Regulation that a business has ceased operations. It is crucial for ensuring that all necessary reports and liabilities are settled.

- Successor Liability Agreement - If a business is sold or transferred, this agreement outlines the responsibilities of the new owner regarding any outstanding unemployment insurance liabilities from the previous owner.

Understanding these documents and their purposes can facilitate a smoother transition during the process of applying for exemption or transferring liability. Proper documentation helps ensure compliance with state regulations and protects both former and new business owners.

Common mistakes

When completing the South Dakota 55 form, individuals often encounter several common mistakes. These errors can lead to delays or complications in processing the application. Below is a list of eight frequent mistakes to avoid:

- Incomplete Account Information: Failing to provide the account number or the owner's name can result in the form being returned for corrections.

- Incorrect Mailing Address: If the mailing address is not accurate, important notifications regarding benefits and claims may not reach the applicant.

- Missing Employment Status: Not indicating whether employment has ceased or if the business has been sold can lead to confusion about the application’s intent.

- Failure to Specify Business Disposition: Leaving the section regarding how the business was disposed of blank can delay the processing of the application.

- Omitting Successor Information: Not providing the name and contact details of the successor can hinder the transfer of liability.

- Incorrect Selection of Organization Type: Choosing the wrong type of organization can affect the eligibility for exemption from unemployment insurance requirements.

- Unsigned Application: An application that is not signed by the owner or authorized official will be considered invalid.

- Neglecting to Provide Effective Dates: Failing to include the effective date of business disposition or the last date wages were paid can lead to complications in the processing timeline.

By paying careful attention to these details, applicants can help ensure that their submission is complete and accurate, facilitating a smoother application process.

Key takeaways

Here are some key takeaways about filling out and using the South Dakota 55 form:

- The South Dakota 55 form is used to apply for exemption from filing unemployment insurance reports.

- Make sure to provide your account number and the names of the business and owner accurately.

- Double-check the mailing address; this is where all important notices will be sent.

- Indicate whether you are ceasing operations or transferring the business by completing the relevant sections.

- If you are transferring the business, provide details about the successor, including their contact information.

- Clarify how much of the Employer’s Experience Rating Account will be transferred with the business.

- Ensure the form is signed by an authorized person, such as the owner or partner.

- Keep a copy of the completed form for your records after submission.

- Contact the South Dakota Department of Labor and Regulation if you have questions or need assistance.