Free South Dakota Small Estate Affidavit Document

In South Dakota, when a loved one passes away and leaves behind a modest estate, the process of settling their affairs can be simplified through the use of a Small Estate Affidavit. This form provides a streamlined way for heirs to claim the deceased's assets without going through the lengthy and often costly probate process. Typically, the Small Estate Affidavit can be utilized when the total value of the estate is below a certain threshold, which can vary over time. By completing this affidavit, individuals can assert their right to inherit property, bank accounts, and other assets directly. The form requires specific information, including details about the deceased, the heirs, and the assets involved. It is essential for the affidavit to be signed under oath, affirming that the information provided is accurate. Once filed, this document allows heirs to take control of the estate efficiently, ensuring that the deceased's wishes are honored while minimizing the burden on family members during a challenging time.

Fill out Other Popular Forms for South Dakota

South Dakota Employee Handbook - This document emphasizes the importance of respect and teamwork in the workplace.

Creating a Last Will and Testament form is crucial for individuals wanting to dictate the distribution of their assets posthumously, providing peace of mind and clarity to their loved ones. For those interested in preparing such an important document, resources like smarttemplates.net can provide helpful templates and guidance to ensure that your final wishes are clearly articulated and legally recognized.

Which One of the Following Is Someone Who Authorizes Another to Act as Agent? - Your agent can pursue medical decisions if the form includes healthcare provisions.

Promissory Note Friendly Loan Agreement Format - In the event of a dispute, this document can serve as a key piece of evidence in negotiations or court proceedings.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The South Dakota Small Estate Affidavit is used to simplify the process of transferring assets from a deceased person's estate when the total value is below a certain threshold. |

| Value Limit | As of 2023, the total value of the estate must be less than $50,000 for an individual or $100,000 for a couple to qualify for this affidavit. |

| Governing Law | The Small Estate Affidavit is governed by South Dakota Codified Laws, specifically under Chapter 29A-3-1201. |

| Eligibility | Only certain individuals, such as the surviving spouse or heirs, can file the affidavit. They must be entitled to inherit under South Dakota law. |

| Required Information | The affidavit must include details about the deceased, a list of assets, and the names of heirs or beneficiaries. |

| Filing Process | The affidavit is typically filed with the county register of deeds in the county where the deceased resided. |

| Notarization | The affidavit must be signed in front of a notary public to ensure its validity. |

| Debt Settlement | While the affidavit allows for asset transfer, it does not absolve the estate of any debts. Creditors may still claim against the estate. |

| Time Frame | There is no specific time limit to file the affidavit, but it is advisable to do so promptly to facilitate the transfer of assets. |

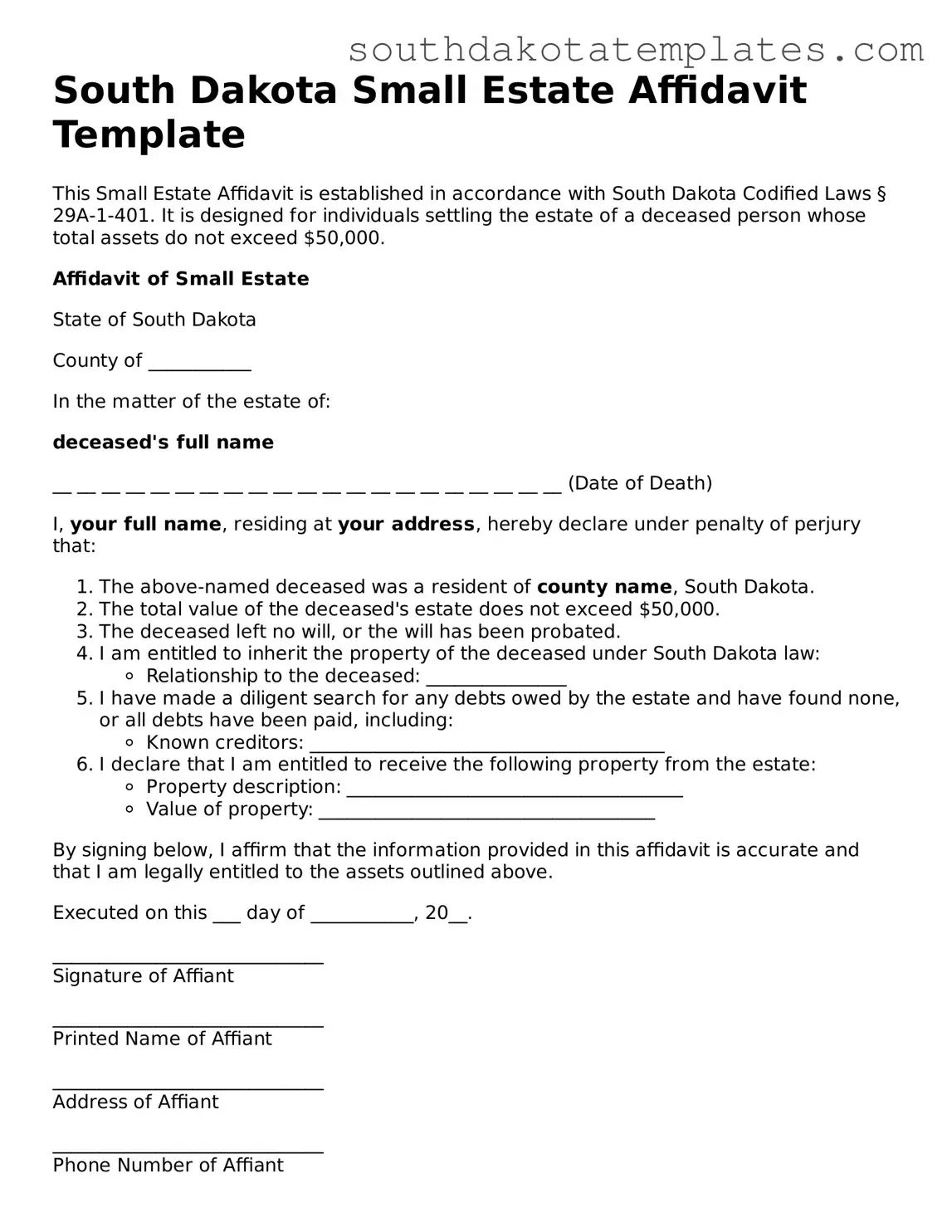

Guidelines on How to Fill Out South Dakota Small Estate Affidavit

After gathering the necessary information and documents, you are ready to fill out the South Dakota Small Estate Affidavit form. This process will help you assert your claim to the deceased's assets without going through the full probate process. Follow these steps to complete the form accurately.

- Begin by downloading the South Dakota Small Estate Affidavit form from the official state website or obtaining a physical copy from a local courthouse.

- At the top of the form, enter the name of the deceased individual as it appears on their legal documents.

- Provide the date of death of the deceased. This information is crucial for the affidavit.

- Fill in the address of the deceased at the time of death, ensuring it is complete and accurate.

- List all known heirs of the deceased. Include their names, addresses, and relationship to the deceased.

- Detail the assets that are part of the small estate. This may include bank accounts, real estate, vehicles, or personal property. Be specific about each item.

- Indicate the total value of the estate. Ensure that this amount does not exceed the limit set by South Dakota law for small estates.

- Include any debts or obligations the deceased had at the time of death. This helps clarify the financial situation of the estate.

- Sign the affidavit in the designated area. Your signature confirms that the information provided is accurate and complete.

- Have the affidavit notarized. A notary public will verify your identity and witness your signature.

- Make copies of the completed and notarized affidavit for your records and for filing with the appropriate court.

Once you have completed these steps, you can file the affidavit with the local probate court. This will initiate the process of transferring the assets to the rightful heirs without the need for a lengthy probate proceeding.

Misconceptions

The South Dakota Small Estate Affidavit form is a useful tool for settling smaller estates without going through the lengthy probate process. However, several misconceptions exist that can lead to confusion. Here are six common misunderstandings:

- Only heirs can use the Small Estate Affidavit. Many believe that only heirs can file this affidavit. In reality, any individual who is entitled to the estate, such as a designated beneficiary or a personal representative, can use the form.

- The Small Estate Affidavit can be used for any estate size. Some people think that the Small Estate Affidavit applies to estates of any size. However, this form is specifically designed for estates that do not exceed a certain value, which is set by South Dakota law. As of now, the limit is $50,000 in personal property.

- All debts must be settled before filing. It is a common belief that all debts of the deceased must be paid off before the Small Estate Affidavit can be filed. While it is important to address debts, the affidavit allows for the transfer of assets before settling all debts, as long as the estate can cover them.

- The process is the same as traditional probate. Many assume that using the Small Estate Affidavit is similar to going through the traditional probate process. In fact, the affidavit simplifies the process, allowing heirs to claim assets without the court's oversight, making it quicker and less expensive.

- Only one affidavit can be filed for an estate. Some individuals think that only a single Small Estate Affidavit can be filed for any given estate. However, multiple affidavits can be filed if there are different assets to claim or if multiple heirs are involved.

- Filing the Small Estate Affidavit is unnecessary if there is a will. There is a misconception that if a will exists, the Small Estate Affidavit is not needed. However, even with a will, if the estate qualifies under the small estate limit, heirs can still utilize the affidavit to expedite the transfer of assets.

Understanding these misconceptions can help individuals navigate the estate settlement process more effectively. It is always advisable to consult with a legal professional for personalized guidance.

Documents used along the form

When navigating the process of settling a small estate in South Dakota, several forms and documents may accompany the Small Estate Affidavit. Each of these documents serves a unique purpose, helping to ensure that the estate is administered smoothly and in accordance with state laws. Below is a list of commonly used forms that may be required in conjunction with the Small Estate Affidavit.

- Death Certificate: This official document verifies the death of the individual whose estate is being settled. It is essential for proving the decedent's passing to initiate the probate process.

- Will: If the deceased left a will, this document outlines their wishes regarding the distribution of their assets. It may also name an executor to handle the estate.

- Affidavit of Heirship: This document can establish the identity of the heirs and their respective shares in the estate when no will exists, providing clarity on who is entitled to the estate's assets.

- Inventory of Assets: A comprehensive list of the decedent's assets, this document helps in assessing the estate's total value and ensures all property is accounted for during distribution.

- Notice to Creditors: This document informs creditors of the decedent's passing and provides them with a timeframe to submit any claims against the estate, helping to settle debts before distribution.

- Tax Returns: Copies of the decedent's final income tax returns may be necessary to ensure that all tax obligations are met before the estate is fully settled.

- Release of Claims: This form may be used by heirs or beneficiaries to formally relinquish any claims against the estate, streamlining the distribution process.

- Boat Bill of Sale: A https://toptemplates.info/bill-of-sale/boat-bill-of-sale/california-boat-bill-of-sale is necessary to document the sale and transfer of ownership of a boat, serving as both a legal receipt and proof of purchase for the buyer.

- Petition for Probate: In cases where the estate may require formal probate proceedings, this petition initiates the court's involvement in overseeing the estate's administration.

- Court Order: If a court has issued any orders regarding the estate, these documents are crucial for ensuring that all parties comply with legal directives.

Understanding these documents can significantly ease the process of settling a small estate in South Dakota. Each form plays a vital role in clarifying the decedent's wishes, establishing the rightful heirs, and ensuring that all legal obligations are met. By gathering the necessary paperwork, individuals can navigate this often-complex process with greater confidence and efficiency.

Common mistakes

When completing the South Dakota Small Estate Affidavit form, individuals may encounter several common mistakes. These errors can lead to delays or complications in the estate settlement process. Below is a list of seven mistakes to avoid:

-

Inaccurate Information: Providing incorrect names, addresses, or dates can result in the form being rejected. Ensure all personal details are accurate and up-to-date.

-

Missing Signatures: The affidavit requires signatures from all relevant parties. Failing to obtain necessary signatures can invalidate the document.

-

Not Including All Assets: Omitting any assets that belong to the deceased can complicate the process. List all assets clearly to avoid issues.

-

Improper Witnesses: The form must be signed in front of appropriate witnesses. Using unqualified witnesses can lead to legal challenges.

-

Ignoring State Requirements: Each state has specific rules regarding small estates. Familiarize yourself with South Dakota's requirements to ensure compliance.

-

Failure to Notarize: Some affidavits require notarization. Neglecting this step can prevent the affidavit from being accepted.

-

Submitting to the Wrong Office: Ensure that the completed affidavit is submitted to the correct local office. Incorrect submissions can delay processing.

By being aware of these common mistakes, individuals can improve their chances of successfully completing the South Dakota Small Estate Affidavit form.

Key takeaways

Filling out and using the South Dakota Small Estate Affidavit form can be a straightforward process if you keep certain key points in mind. Here are ten essential takeaways to consider:

- Eligibility Requirements: Ensure that the estate qualifies as a small estate under South Dakota law. The total value of the estate must not exceed a specified limit.

- Form Availability: Obtain the Small Estate Affidavit form from the South Dakota Unified Judicial System website or local county offices.

- Accurate Information: Fill out the form with precise and accurate details about the deceased, including their full name, date of death, and last known address.

- Asset Listing: Clearly list all assets that are part of the estate. This includes bank accounts, real estate, and personal property.

- Debts and Liabilities: Disclose any known debts or liabilities of the deceased. This is crucial for a transparent process.

- Signature Requirement: The affidavit must be signed by the person claiming the estate, affirming the accuracy of the information provided.

- Witnesses: Depending on the specific requirements, you may need witnesses to sign the affidavit, confirming the validity of your claims.

- Filing Process: Submit the completed affidavit to the appropriate county court. Follow any local filing procedures to avoid delays.

- Potential Delays: Be aware that the court may take time to process the affidavit, especially if there are disputes or complications.

- Legal Advice: Consider seeking legal advice if you encounter difficulties or if the estate is contested. Professional guidance can help navigate complex situations.

Understanding these key points can help streamline the process of managing a small estate in South Dakota. Take action promptly to ensure compliance with legal requirements.