Free South Dakota Real Estate Purchase Agreement Document

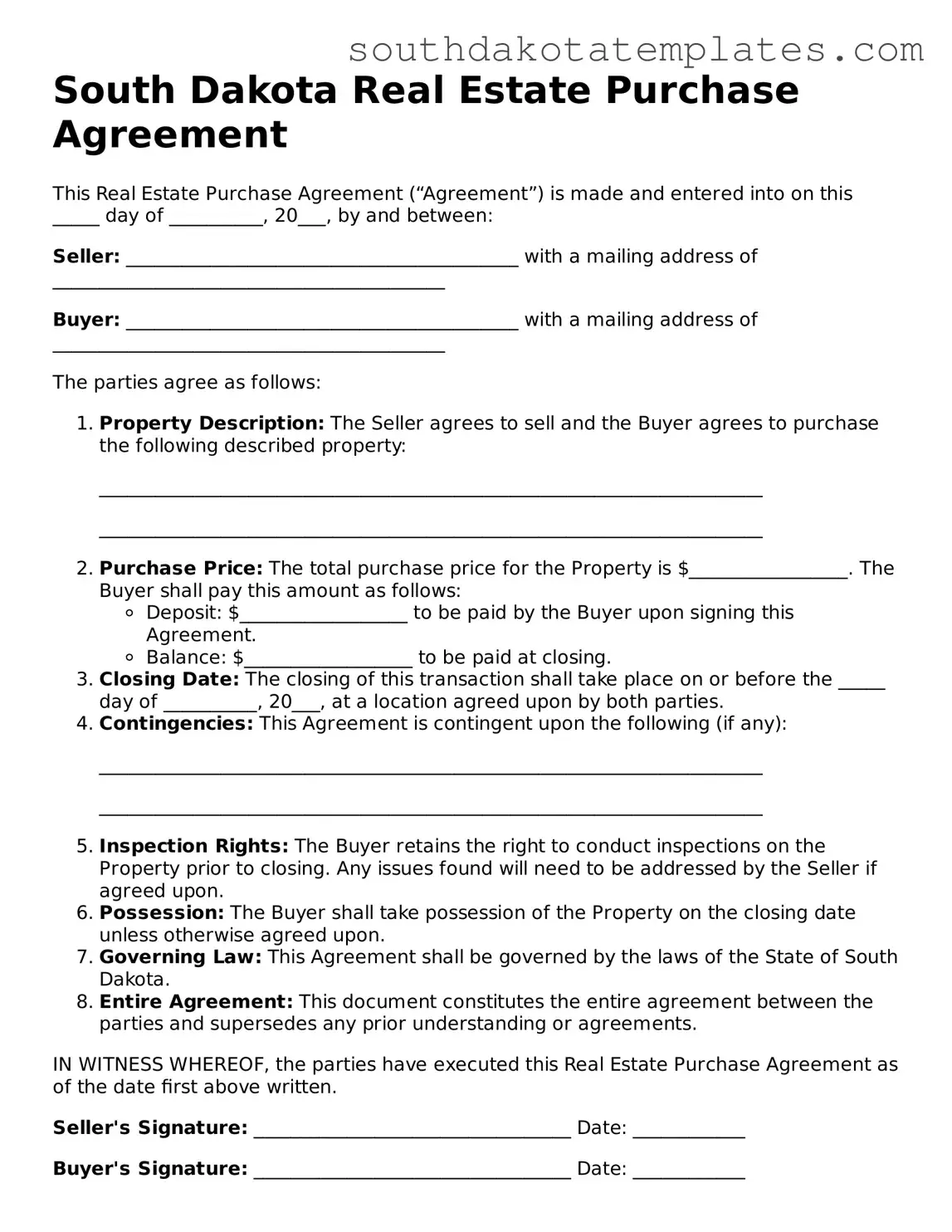

When navigating the world of real estate transactions in South Dakota, understanding the Real Estate Purchase Agreement form is essential for both buyers and sellers. This document serves as a binding contract that outlines the terms and conditions of a property sale. It typically includes critical elements such as the purchase price, financing details, and contingencies that protect both parties. Additionally, the agreement addresses important aspects like the closing date, property disclosures, and any potential repairs or inspections required before the sale is finalized. By clearly defining the roles and responsibilities of each party, the form aims to facilitate a smooth transaction while minimizing misunderstandings. Whether you are a first-time homebuyer or an experienced investor, familiarizing yourself with this form can empower you to make informed decisions and ensure a successful real estate experience in the Mount Rushmore State.

Fill out Other Popular Forms for South Dakota

How to Write an Operating Agreement - An Operating Agreement is a key document for LLCs that outlines the management structure and operating procedures of the company.

Dmv Registration Sticker - Effective way to communicate sale conditions in writing.

Utilizing a properly drafted Last Will and Testament is crucial for anyone looking to ensure their estate is managed according to their preferences. For more information on creating such a document, you can visit this comprehensive resource on the Last Will and Testament form.

Printable Bill of Sale South Dakota - The form can be completed in a straightforward manner, requiring only essential information.

File Specifics

| Fact Name | Description |

|---|---|

| Governing Law | The South Dakota Real Estate Purchase Agreement is governed by South Dakota state law, particularly under the South Dakota Codified Laws Title 43. |

| Purpose | This form serves as a legal document outlining the terms and conditions for the purchase of real estate in South Dakota. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be clearly identified in the document. |

| Deposit Requirements | It usually specifies the amount of earnest money the buyer must provide as a deposit to secure the agreement. |

| Contingencies | The form may include various contingencies, such as financing or inspection, that must be met for the sale to proceed. |

Guidelines on How to Fill Out South Dakota Real Estate Purchase Agreement

Filling out the South Dakota Real Estate Purchase Agreement form is an important step in the home buying process. It outlines the terms of the sale and protects the interests of both the buyer and the seller. Follow these steps to complete the form accurately.

- Identify the Parties: Begin by entering the full names and addresses of the buyer and seller at the top of the form.

- Property Description: Provide a detailed description of the property being sold, including the address and any relevant legal descriptions.

- Purchase Price: Clearly state the agreed-upon purchase price for the property.

- Earnest Money: Specify the amount of earnest money the buyer will deposit and the terms regarding its handling.

- Financing Terms: Include details about how the buyer intends to finance the purchase, such as a mortgage or cash payment.

- Closing Date: Indicate the proposed closing date for the transaction.

- Contingencies: List any contingencies that must be met for the sale to proceed, such as inspections or financing approval.

- Additional Terms: Write any additional terms or conditions that both parties have agreed upon.

- Signatures: Ensure both the buyer and seller sign and date the agreement to make it legally binding.

After completing the form, review it carefully to ensure all information is accurate. Both parties should keep a copy for their records. It's advisable to consult with a legal professional if there are any questions or concerns about the terms outlined in the agreement.

Misconceptions

When it comes to the South Dakota Real Estate Purchase Agreement form, several misconceptions can lead to confusion among buyers and sellers. Understanding the truth behind these myths is essential for anyone involved in a real estate transaction in the state. Here’s a list of common misconceptions:

- It’s a standard form that can be used in any real estate transaction. Many believe that the Real Estate Purchase Agreement is a one-size-fits-all document. In reality, the form should be tailored to the specific details of each transaction, including property type and buyer-seller agreements.

- Verbal agreements are just as binding as written ones. Some individuals think that a verbal agreement can hold the same weight as a written contract. However, in real estate, having a written agreement is crucial for legal enforceability and clarity.

- All contingencies are automatically included. Many assume that standard contingencies, such as financing or inspection clauses, are included by default. In truth, these must be explicitly stated in the agreement to ensure protection for the buyer or seller.

- Once signed, the agreement cannot be changed. There is a belief that a signed Real Estate Purchase Agreement is set in stone. However, amendments can be made if both parties agree to the changes, provided they are documented in writing.

- Only real estate agents can fill out the form. Some people think that only licensed agents can complete the Real Estate Purchase Agreement. In fact, buyers and sellers can fill it out themselves, though consulting a professional is often advisable for accuracy.

- It’s only necessary for residential transactions. There is a misconception that the form is only relevant for residential properties. However, it is also applicable to commercial real estate transactions and land sales.

- Signing the agreement guarantees the sale will go through. Many assume that signing the purchase agreement guarantees the transaction will be completed. In reality, various factors, such as financing issues or failed inspections, can still prevent the sale from finalizing.

Understanding these misconceptions can help individuals navigate the complexities of real estate transactions in South Dakota more effectively. Always consider seeking professional guidance to ensure that all aspects of the agreement are understood and properly addressed.

Documents used along the form

When engaging in a real estate transaction in South Dakota, several forms and documents often accompany the Real Estate Purchase Agreement. Each of these documents serves a specific purpose, ensuring that both buyers and sellers are protected and informed throughout the process. Here’s a list of commonly used forms and documents:

- Disclosure Statement: This document outlines any known issues with the property, such as structural problems or environmental hazards. Sellers must provide this information to buyers to ensure transparency.

- Release of Liability: This form allows individuals to waive their right to sue for potential claims of harm. For more information, visit https://smarttemplates.net/fillable-california-release-of-liability/.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential risks of lead-based paint. It is essential for protecting the health of occupants, especially children.

- Property Inspection Report: After a property inspection, this report details the condition of the home, including any necessary repairs. It helps buyers make informed decisions based on the property's state.

- Title Report: This document provides information on the property's title, including any liens or encumbrances. A clear title is crucial for a successful transaction.

- Closing Statement: Also known as the HUD-1 Settlement Statement, this document itemizes all closing costs associated with the transaction. It ensures that both parties understand their financial obligations at closing.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be effective.

- Mortgage Agreement: If the buyer is financing the purchase, this document outlines the terms of the loan, including interest rates and repayment schedules.

- Home Warranty Agreement: This optional document provides coverage for repairs or replacements of major home systems and appliances for a specified period after purchase.

- Affidavit of Title: This sworn statement confirms the seller’s ownership of the property and that there are no undisclosed liens or claims against it.

- Escrow Agreement: This document outlines the terms under which an escrow agent will hold funds and documents until all conditions of the sale are met.

Understanding these documents can significantly enhance your experience in the real estate market. Each form plays a vital role in protecting the interests of both buyers and sellers, ensuring a smooth transaction process. Always consult with a qualified real estate professional to navigate these documents effectively.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to confusion or delays. Ensure that names, addresses, and other essential details are provided clearly.

-

Incorrect Property Description: Providing an inaccurate or vague description of the property can cause issues later. Be specific about the property’s address and any included features.

-

Missing Signatures: All parties involved must sign the agreement. Neglecting to obtain necessary signatures can render the document invalid.

-

Ignoring Contingencies: Not including contingencies, such as financing or inspection clauses, may lead to unexpected problems. Always address these important aspects.

-

Failure to Specify Closing Costs: Not detailing who is responsible for closing costs can create misunderstandings. Clearly outline these costs to avoid disputes.

-

Overlooking Dates: Missing important dates, like the closing date or inspection deadline, can disrupt the transaction process. Be diligent in noting all relevant timelines.

-

Neglecting to Review Terms: Skipping a thorough review of the agreement can lead to overlooking critical terms. Take the time to read everything carefully before signing.

-

Assuming Standard Terms: Assuming that standard terms apply without checking can lead to misunderstandings. Ensure that all terms are tailored to the specific transaction.

Key takeaways

When engaging in a real estate transaction in South Dakota, understanding the Real Estate Purchase Agreement is crucial. Here are some key takeaways to keep in mind:

- Understand the Basics: The Real Estate Purchase Agreement outlines the terms of the sale, including the purchase price, property description, and closing date.

- Complete All Sections: Ensure that every section of the form is filled out accurately. Missing information can lead to disputes or delays in the transaction.

- Contingencies Are Important: Include any contingencies that may be necessary, such as financing, inspections, or the sale of another property. These protect your interests.

- Review Deadlines: Pay attention to all deadlines outlined in the agreement. Timely responses and actions are essential to keep the transaction on track.

- Seek Legal Advice: Before signing, consider consulting with a real estate attorney. They can help clarify any legal terms and ensure your rights are protected.

Being thorough and informed while filling out the South Dakota Real Estate Purchase Agreement can significantly impact the success of your transaction. Take the time to understand each aspect of the form, and do not hesitate to seek professional guidance when needed.