Free South Dakota Quitclaim Deed Document

The South Dakota Quitclaim Deed form serves as a vital legal document in property transactions, allowing the transfer of real estate ownership from one party to another without any warranties or guarantees regarding the title. This form is particularly useful in situations where the grantor, the person transferring the property, may not have complete knowledge of the title’s status or when the transfer is between family members or close associates. By utilizing a quitclaim deed, the grantor relinquishes any claim they may have to the property, but the recipient, or grantee, receives no assurances about potential liens or encumbrances. This document typically includes essential details such as the names of the parties involved, a legal description of the property, and the date of the transfer. It must be signed by the grantor in the presence of a notary public to ensure its validity. Understanding the implications of a quitclaim deed is crucial, as it can simplify the transfer process but also carries risks for the grantee, who must be aware of the property’s potential legal issues.

Fill out Other Popular Forms for South Dakota

South Dakota Rental Agreement - This document specifies the rental amount, lease duration, and property details.

How to Write an Operating Agreement - This document can clarify the tax treatment for the LLC and its members.

Creating a comprehensive Last Will and Testament is vital for ensuring that your assets are handled according to your wishes, providing peace of mind for both you and your loved ones. For those interested in drafting this important document, resources such as smarttemplates.net can offer guidance and templates to simplify the process.

South Dakota Poa - Provides a framework for consistent care when parents are distant.

File Specifics

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real property without any warranties or guarantees about the title. |

| Governing Law | The South Dakota Quitclaim Deed is governed by South Dakota Codified Laws, specifically Chapter 43-25. |

| Purpose | This form is commonly used in situations where the parties know each other, such as transferring property between family members or in divorce settlements. |

| Execution Requirements | The deed must be signed by the grantor (the person transferring the property) and notarized to be legally valid. |

| Recordation | To protect the interests of the new owner, the quitclaim deed should be filed with the county register of deeds in the county where the property is located. |

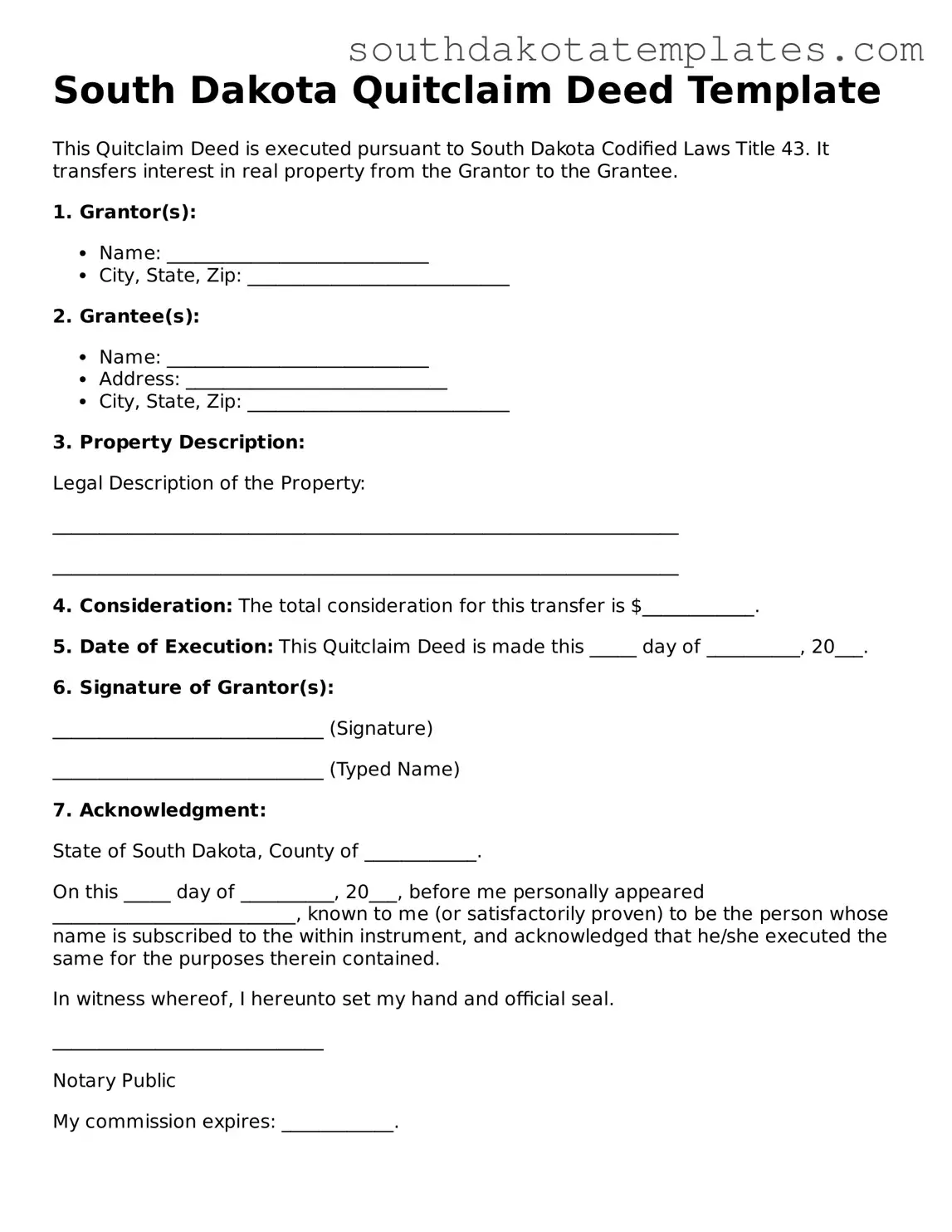

Guidelines on How to Fill Out South Dakota Quitclaim Deed

Once you have the South Dakota Quitclaim Deed form in hand, it’s time to fill it out accurately. This form will require specific details about the property and the parties involved. Ensuring that all information is correct will help facilitate a smooth transfer of property rights.

- Obtain the Quitclaim Deed Form: You can find the form online or at your local county recorder's office. Make sure you have the most current version.

- Identify the Grantor: Fill in the name of the person or entity transferring the property. Include their address for clarity.

- Identify the Grantee: Enter the name of the person or entity receiving the property. Again, include their address.

- Describe the Property: Provide a complete legal description of the property. This might include the lot number, block number, and any relevant subdivision details. You can find this information on the property’s deed or tax records.

- State the Consideration: Indicate the amount of money or value exchanged for the property. If it’s a gift, you can write “$0” or “love and affection.”

- Sign the Document: The grantor must sign the deed in the presence of a notary public. Ensure that the signature matches the name on the form.

- Notarization: The notary will verify the identity of the grantor and witness the signing of the document. They will then stamp and sign the deed.

- Record the Deed: Take the completed and notarized Quitclaim Deed to the county recorder's office where the property is located. Pay any required recording fees.

After completing these steps, the Quitclaim Deed will be officially recorded, and the transfer of property rights will be recognized. Keep a copy of the recorded deed for your records, as it serves as proof of ownership.

Misconceptions

Here are nine common misconceptions about the South Dakota Quitclaim Deed form, along with explanations to clarify each one:

-

A Quitclaim Deed transfers ownership of property.

This is partially true. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property or that there are no liens or other claims against it.

-

Quitclaim Deeds are only used between family members.

While often used in family transactions, Quitclaim Deeds can be used in any situation where property ownership needs to be transferred, including sales and transfers between strangers.

-

A Quitclaim Deed is the same as a Warranty Deed.

These two types of deeds are different. A Warranty Deed offers guarantees about the title, while a Quitclaim Deed does not provide any warranties about ownership or claims.

-

You need an attorney to complete a Quitclaim Deed.

While it's advisable to consult an attorney for guidance, it is not legally required. Many people complete Quitclaim Deeds on their own, provided they understand the process.

-

A Quitclaim Deed can remove a person's name from a mortgage.

This is a misconception. A Quitclaim Deed only transfers ownership of the property, not the mortgage obligation. The person named on the mortgage remains liable unless the mortgage is refinanced or paid off.

-

Once a Quitclaim Deed is signed, it cannot be revoked.

In general, a Quitclaim Deed is final once executed and recorded. However, it may be possible to challenge the deed in court under certain circumstances, such as fraud or duress.

-

Quitclaim Deeds are only valid if notarized.

While notarization is highly recommended to prevent disputes, the validity of a Quitclaim Deed can also depend on proper execution and recording with the county.

-

All states have the same Quitclaim Deed requirements.

Each state has its own rules and requirements for Quitclaim Deeds. South Dakota has specific regulations that must be followed for the deed to be valid.

-

A Quitclaim Deed eliminates all property disputes.

This is incorrect. A Quitclaim Deed does not resolve existing disputes or claims against the property. It merely transfers the interest of the grantor.

Documents used along the form

When dealing with property transfers in South Dakota, the Quitclaim Deed is a common legal document used to convey ownership. However, it is often accompanied by other forms and documents that play essential roles in the transaction process. Below is a list of some of these documents, each serving a specific purpose.

- Warranty Deed: This document guarantees that the grantor holds clear title to the property and has the right to transfer it. It provides more protection to the grantee compared to a quitclaim deed.

- Real Estate Purchase Agreement: A contract between the buyer and seller outlining the terms of the sale, including price, financing, and contingencies. This document is crucial for establishing the details of the transaction.

- Title Insurance Policy: This insurance protects the buyer and lender from potential losses due to defects in the title. It ensures that the title is free of liens or other claims that could affect ownership.

- Property Transfer Declaration: A form required by South Dakota law that provides information about the property transfer, including the sale price and property description. It is typically filed with the county auditor.

- Affidavit of Title: A sworn statement by the seller affirming that they own the property and disclosing any known issues. This document helps to clarify the status of the title before the transfer is completed.

- Closing Statement: A document that outlines all financial aspects of the transaction, including costs, fees, and the final amount due at closing. This statement is crucial for both parties to understand their financial obligations.

- California Boat Bill of Sale: This form is essential for documenting the sale and transfer of ownership of a boat. For more information and access to a template, visit https://toptemplates.info/bill-of-sale/boat-bill-of-sale/california-boat-bill-of-sale/.

- Power of Attorney: A legal document allowing one person to act on behalf of another in legal or financial matters. This may be necessary if one party cannot be present during the transaction.

Understanding these documents can greatly facilitate the property transfer process in South Dakota. Each plays a vital role in ensuring that the transaction is completed smoothly and legally, protecting the interests of all parties involved.

Common mistakes

-

Incorrect Property Description: One of the most common mistakes is failing to provide an accurate and complete description of the property. This includes not specifying the lot number, block number, or the legal description. Omitting these details can lead to confusion and potential disputes.

-

Improper Signatures: All parties involved must sign the Quitclaim Deed. A mistake often made is having only one party sign or failing to have the signatures notarized. Notarization is crucial for the deed to be valid and enforceable.

-

Missing Date: The date of execution is an essential element of the Quitclaim Deed. Forgetting to include the date can cause issues with the timing of the transfer and affect the rights of the parties involved.

-

Failure to Include Consideration: While a Quitclaim Deed can be executed without monetary exchange, it is important to indicate any consideration, even if it is nominal. Leaving this section blank may raise questions about the intent of the transfer.

-

Not Checking Local Requirements: Each county may have specific requirements for recording a Quitclaim Deed. Not verifying local regulations can lead to the deed being rejected or delayed in processing.

-

Neglecting to Record the Deed: After completing the Quitclaim Deed, some individuals forget to file it with the appropriate county office. This step is crucial, as failing to record the deed can result in complications regarding ownership and title disputes in the future.

Key takeaways

When dealing with the South Dakota Quitclaim Deed form, several important points should be considered to ensure a smooth process. Here are key takeaways:

- The Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. This means the new owner may inherit any existing liens or claims against the property.

- It is essential to include the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) accurately to avoid future disputes.

- All property descriptions must be precise. Vague or incorrect descriptions can lead to complications in ownership claims.

- Signatures of both parties are required, and notarization is necessary to validate the document. This ensures that the transfer is legally recognized.

- Filing the Quitclaim Deed with the appropriate county office is crucial. This step officially records the transfer and protects the rights of the new owner.

- Consulting with a legal professional can provide clarity and guidance, especially if there are concerns about the property's title or potential liabilities.