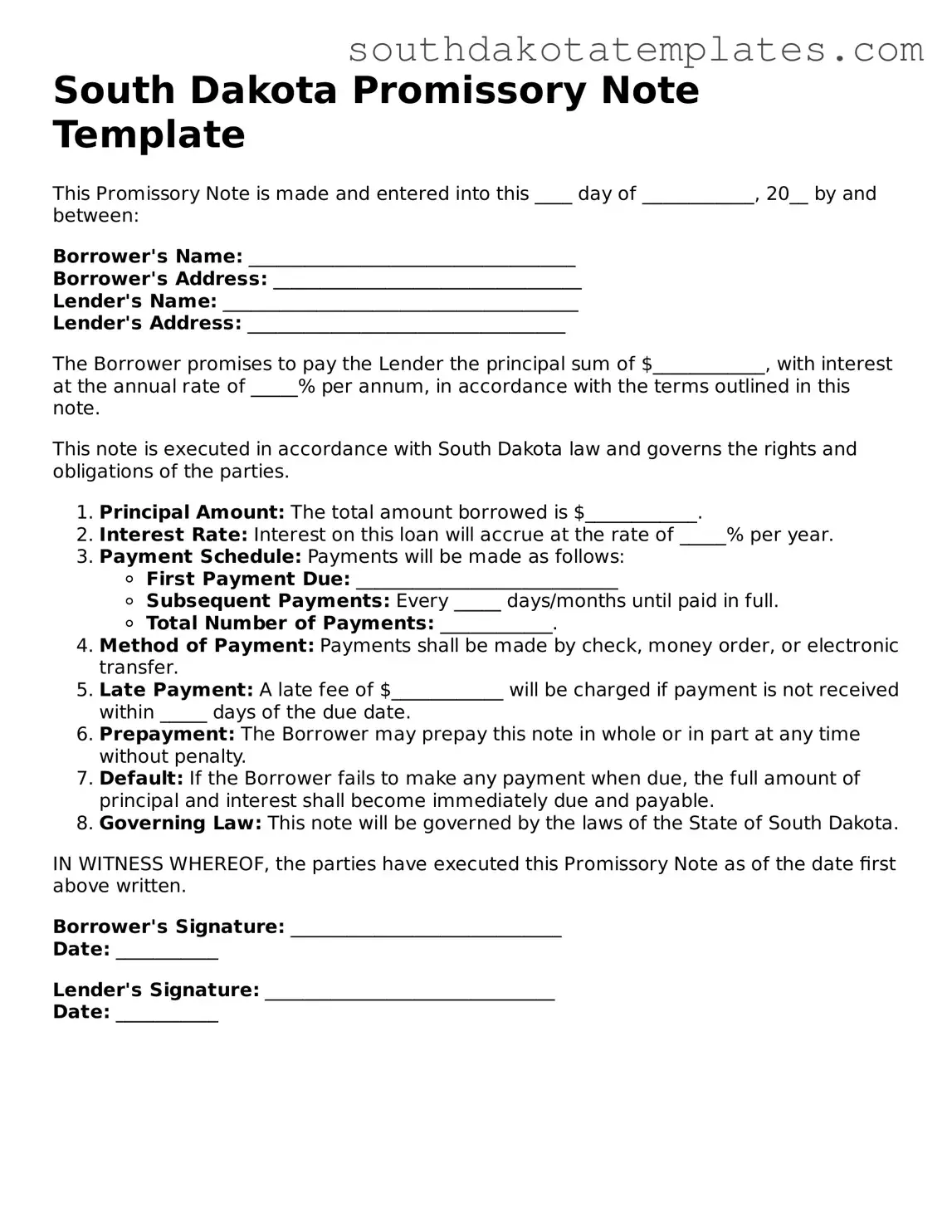

Free South Dakota Promissory Note Document

The South Dakota Promissory Note form serves as a crucial financial instrument for individuals and businesses alike, facilitating the borrowing and lending process. This document outlines the terms of a loan, detailing the amount borrowed, interest rates, repayment schedule, and any collateral involved. By clearly stating the obligations of both the borrower and the lender, it helps to prevent misunderstandings and disputes. In South Dakota, specific legal requirements must be met for the note to be enforceable, including signatures from both parties and the date of the agreement. Understanding these key elements is essential for anyone entering into a lending arrangement, as they provide clarity and protection for all parties involved. Whether you are a lender seeking to secure your investment or a borrower needing funds, the South Dakota Promissory Note form is an indispensable tool in your financial dealings.

Fill out Other Popular Forms for South Dakota

How to Become a Resident of South Dakota - Serves to help establish a legal identity linked to your residence.

Transfer on Death Deed South Dakota - This tool can provide a straightforward solution to property transfer, especially for those with modest estates.

When creating a Lease Agreement, it is crucial to use a reliable source to ensure all necessary elements are included, and one such resource is smarttemplates.net, which offers templates that can help streamline this process.

South Dakota Real Estate Purchase Agreement - Provisions for possession date following closing are often included in the agreement.

File Specifics

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a certain time. |

| Governing Law | The South Dakota Promissory Note is governed by South Dakota Codified Laws, specifically Chapter 57A-3. |

| Parties Involved | There are typically two parties: the maker (the borrower) and the payee (the lender). |

| Interest Rate | The interest rate can be fixed or variable, and it must be clearly stated in the note. |

| Payment Terms | Payment terms should include the amount due, payment schedule, and any late fees. |

| Signature Requirement | The note must be signed by the maker to be legally binding. |

| Notarization | Notarization is not required in South Dakota, but it can add an extra layer of authenticity. |

| Default Clauses | It’s advisable to include default clauses outlining what happens if the borrower fails to pay. |

| Transferability | Promissory notes can be transferred or assigned to another party, unless otherwise stated. |

Guidelines on How to Fill Out South Dakota Promissory Note

After obtaining the South Dakota Promissory Note form, it is essential to fill it out accurately to ensure clarity and enforceability. Follow these steps to complete the form correctly.

- Identify the Borrower and Lender: Enter the full legal names and addresses of both the borrower and the lender at the top of the form.

- Specify the Loan Amount: Clearly state the total amount of money being borrowed in both numbers and words.

- Set the Interest Rate: Indicate the annual interest rate applicable to the loan. Make sure it is expressed as a percentage.

- Define the Payment Terms: Specify the payment schedule, including the frequency of payments (monthly, quarterly, etc.) and the due dates.

- Include the Maturity Date: Write the date by which the loan must be fully repaid.

- Detail Late Fees: If applicable, outline any fees that will be incurred for late payments.

- Signatures: Ensure both the borrower and lender sign and date the form. Include spaces for printed names below each signature.

Once the form is filled out, keep copies for both parties. It is advisable to review the document for accuracy before finalizing the agreement.

Misconceptions

When it comes to the South Dakota Promissory Note form, several misconceptions can lead to confusion for those looking to use it. Understanding these misconceptions is essential for ensuring that the note is properly utilized and legally binding. Here are four common misunderstandings:

- Misconception 1: A Promissory Note is the same as a loan agreement.

- Misconception 2: The South Dakota Promissory Note form must be notarized to be valid.

- Misconception 3: All Promissory Notes are the same regardless of state laws.

- Misconception 4: A verbal agreement is sufficient to create a Promissory Note.

While both documents relate to borrowing money, a Promissory Note specifically outlines the borrower's promise to repay the loan, including the amount, interest rate, and repayment schedule. A loan agreement, on the other hand, may include additional terms and conditions beyond just the repayment promise.

In South Dakota, notarization is not a requirement for a Promissory Note to be enforceable. However, having the document notarized can provide an extra layer of security and help prevent disputes regarding its authenticity.

Each state has its own laws governing Promissory Notes, which means that the terms and requirements can vary. South Dakota has specific guidelines that must be followed to ensure that a Promissory Note is valid and enforceable within its jurisdiction.

While verbal agreements can be legally binding in some cases, a written Promissory Note is strongly recommended. A written document provides clear evidence of the terms and can help avoid misunderstandings or disputes in the future.

Documents used along the form

When dealing with a South Dakota Promissory Note, several other documents and forms may be necessary to ensure a clear understanding of the agreement and to protect the interests of all parties involved. Below is a list of commonly used forms that often accompany a Promissory Note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive agreement between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, a Security Agreement is required. This document details the specific assets that back the loan and outlines the lender's rights in the event of default.

- Disclosure Statement: This form provides essential information about the loan, including the total cost of the loan, interest rates, and any fees. It ensures that the borrower fully understands the financial implications of the agreement.

- Asurion F-017-08 MEN Form: This document is essential for specific service requests and claims related to warranty coverage. Proper completion facilitates communication between customers and the service provider, ensuring a smoother resolution process. For more details, refer to the Sworn Affidavit & Proof of Loss Statement.

- Payment Schedule: A Payment Schedule is a detailed outline of when payments are due and how much each payment will be. This document helps both parties keep track of the repayment timeline and obligations.

- Default Notice: In the event that the borrower fails to make payments, a Default Notice may be issued. This document formally notifies the borrower of their default status and may outline the steps the lender intends to take.

- Amendment Agreement: If any changes to the original terms of the Promissory Note are necessary, an Amendment Agreement is used. This document outlines the specific changes agreed upon by both parties and ensures that all modifications are legally binding.

Each of these documents plays a vital role in the loan process, providing clarity and protection for both the lender and the borrower. Properly preparing and executing these forms can help avoid misunderstandings and legal complications in the future.

Common mistakes

-

Incorrect Borrower Information: Many people forget to include complete details about the borrower. Ensure that the name, address, and contact information are accurate and up-to-date.

-

Missing Lender Details: Some forms lack the lender's information. Always provide the full name and address of the lender to avoid confusion later.

-

Improper Loan Amount: Double-check the loan amount. Errors in this section can lead to disputes down the line. Write the amount clearly in both numbers and words.

-

Omitting Payment Terms: Not specifying the repayment schedule is a common mistake. Clearly outline when payments are due and the frequency of those payments.

-

Neglecting Signatures: Some individuals forget to sign the document. Both the borrower and lender must sign the promissory note for it to be valid.

-

Ignoring State Requirements: Each state has specific rules. Failing to comply with South Dakota’s regulations can render the note unenforceable.

Key takeaways

When filling out and using the South Dakota Promissory Note form, it’s important to keep several key points in mind. Here are some essential takeaways:

- Understand the Purpose: A promissory note is a legal document that outlines a promise to repay a loan. It serves as evidence of the debt.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that both parties are easily identifiable.

- Specify the Loan Amount: Clearly indicate the total amount of money being borrowed. This figure should be accurate and unambiguous.

- Detail the Interest Rate: If applicable, include the interest rate that will be charged on the borrowed amount. This can be fixed or variable.

- Outline the Repayment Terms: Specify how and when the borrower will repay the loan. Include details such as payment frequency and due dates.

- Include Default Terms: It’s wise to outline what happens if the borrower fails to make payments. This can include late fees or legal actions.

- Sign and Date: Both parties must sign and date the document to make it legally binding. Ensure that all signatures are in place before any funds are exchanged.

By following these guidelines, you can create a clear and effective promissory note that protects the interests of both the borrower and the lender.