Free South Dakota Power of Attorney Document

In South Dakota, the Power of Attorney form is a crucial legal document that allows individuals to appoint someone else to manage their financial or healthcare decisions when they are unable to do so themselves. This form empowers a designated agent to act on behalf of the principal, ensuring that important matters are handled according to their wishes. Whether it’s managing bank accounts, signing documents, or making medical choices, the Power of Attorney can cover a wide range of responsibilities. It can be tailored to be effective immediately or only in specific situations, such as when the principal becomes incapacitated. Understanding the nuances of this form is essential for anyone looking to safeguard their interests and ensure that their affairs are in capable hands. The flexibility of the Power of Attorney also allows individuals to set clear limits on the agent’s authority, providing peace of mind in uncertain times. By taking the time to establish this document, individuals can create a safety net for themselves and their loved ones, ensuring that their preferences are honored even when they cannot express them directly.

Fill out Other Popular Forms for South Dakota

Affidavit of Acknowledgement - This form documents the identity of the signer in a legally recognized manner.

Having a well-drafted Operating Agreement is essential for any Limited Liability Company (LLC) to ensure clarity and prevent misunderstandings among members. By clearly defining member rights and responsibilities, as well as financial and operational protocols, this document serves as a cornerstone for effective management. For further insights and templates to assist in creating an Operating Agreement, visit TopTemplates.info.

What Is a Hold Harmless Agreement - This form reinforces the importance of personal accountability in shared activities.

File Specifics

| Fact Name | Description |

|---|---|

| Definition | A South Dakota Power of Attorney form allows an individual (the principal) to designate another person (the agent) to make decisions on their behalf. |

| Governing Law | The South Dakota Power of Attorney is governed by South Dakota Codified Laws, specifically Chapter 59-12. |

| Durability | This form can be made durable, meaning it remains effective even if the principal becomes incapacitated. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent to do so. |

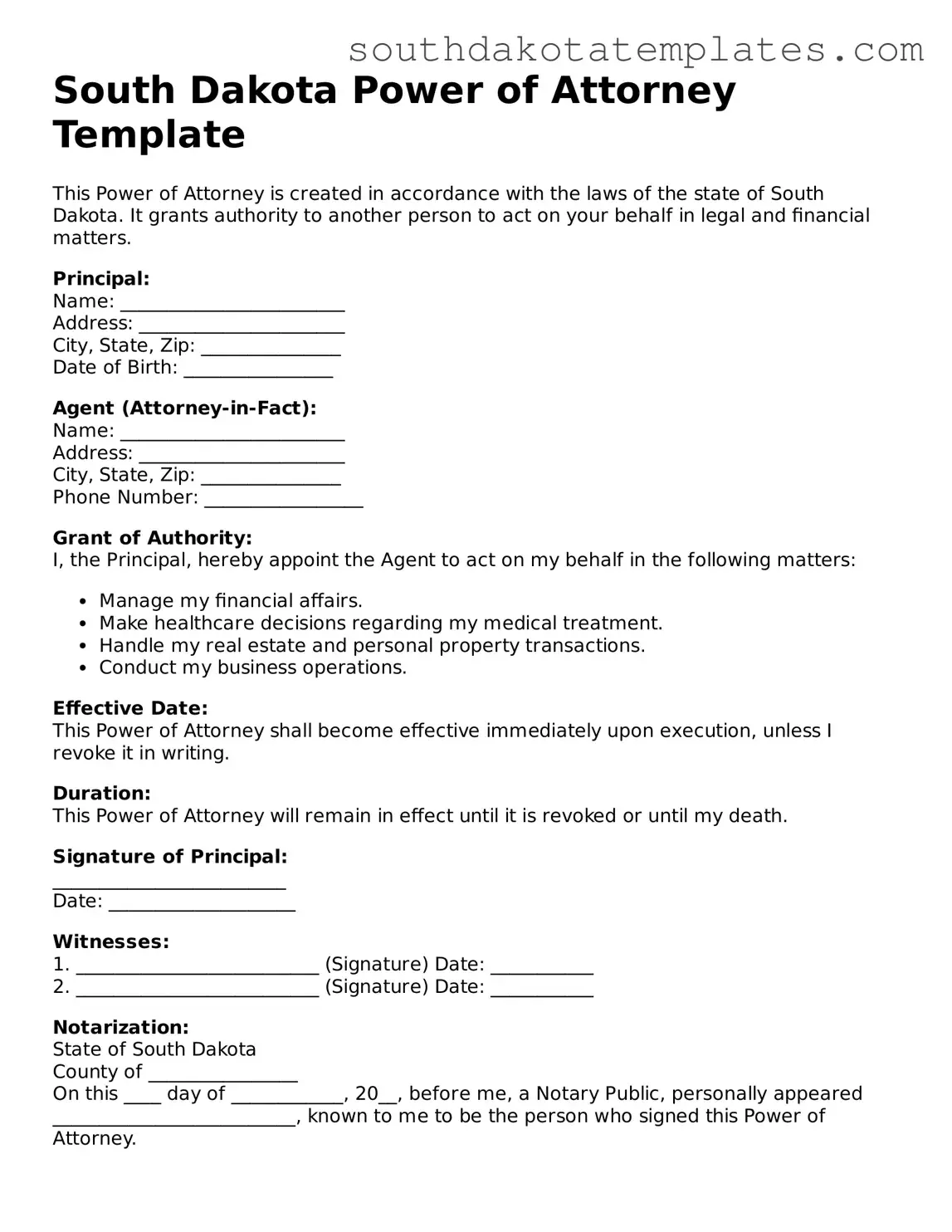

Guidelines on How to Fill Out South Dakota Power of Attorney

Completing the South Dakota Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes. After filling out the form, it will need to be signed and possibly notarized, depending on your specific situation.

- Obtain the South Dakota Power of Attorney form. This can be found online or through local legal offices.

- Read the form carefully. Familiarize yourself with the sections and the information required.

- Fill in your name and address in the designated area. This identifies you as the principal.

- Provide the name and address of the person you are appointing as your agent. This individual will act on your behalf.

- Specify the powers you wish to grant to your agent. This may include financial decisions, property management, or other legal matters.

- Indicate the duration of the power of attorney. Decide if it will be effective immediately or only under certain conditions.

- Review the completed form for accuracy. Ensure all information is correct and clearly written.

- Sign and date the form in the presence of a notary public, if required. This adds an extra layer of validity to the document.

- Provide copies of the signed form to your agent and any relevant institutions, such as banks or healthcare providers.

Misconceptions

When it comes to the South Dakota Power of Attorney form, several misconceptions often arise. Understanding these can help individuals make informed decisions about their legal rights and responsibilities. Below are some common misconceptions, along with clarifications to dispel any confusion.

- Misconception 1: A Power of Attorney is only for financial matters.

- Misconception 2: A Power of Attorney is permanent and cannot be revoked.

- Misconception 3: Anyone can serve as my agent under a Power of Attorney.

- Misconception 4: A Power of Attorney is only necessary for the elderly or those with health issues.

- Misconception 5: A Power of Attorney automatically goes into effect when signed.

This is not true. While many people associate Power of Attorney with financial decisions, it can also cover healthcare and other personal matters. You can specify what decisions your agent can make on your behalf, including medical treatment decisions.

In reality, a Power of Attorney can be revoked at any time, as long as the person who created it is still competent. It is essential to formally revoke it in writing to avoid any confusion.

While you have the freedom to choose your agent, it is important to select someone you trust implicitly. This person will have significant authority over your affairs, so choose wisely.

This misconception overlooks the fact that anyone can benefit from having a Power of Attorney. Unexpected situations can arise at any age, making it prudent for anyone to consider establishing this legal document.

Actually, a Power of Attorney can be set up to take effect immediately, or it can be designated to become effective only under certain conditions, such as incapacity. This flexibility allows individuals to tailor the document to their specific needs.

Documents used along the form

When creating a Power of Attorney in South Dakota, several additional forms and documents may be necessary to ensure comprehensive coverage of your legal and financial needs. Here are some commonly used documents that complement the Power of Attorney form:

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. It provides continued authority to the agent to manage the principal's affairs.

- Lease Agreement: For those renting property in New York, understanding the terms of the lease agreement is essential to avoid any disputes. Resources such as smarttemplates.net can provide valuable templates to facilitate this process.

- Advance Healthcare Directive: This form allows individuals to outline their healthcare preferences and appoint someone to make medical decisions on their behalf if they are unable to do so.

- Living Will: A living will specifies an individual's wishes regarding end-of-life medical treatment. It serves as guidance for healthcare providers and family members during critical times.

- Financial Power of Attorney: This document grants authority specifically for financial matters, allowing the agent to handle banking, investments, and other financial transactions.

- Trust Document: A trust can be established to manage assets during a person's lifetime and after their death. This document outlines how the assets should be handled and distributed.

- Will: A will outlines how a person's assets should be distributed after their death. It names an executor who will carry out the wishes of the deceased.

- Property Deed: If real estate is involved, a property deed may be necessary to transfer ownership. This document details the legal description of the property and the parties involved.

These documents work together to provide a comprehensive legal framework for managing personal and financial affairs. It is essential to consider each one carefully to ensure that your wishes are respected and your interests are protected.

Common mistakes

-

Not Specifying Powers Clearly: One common mistake is failing to clearly outline the powers granted. It’s essential to be specific about what the agent can and cannot do. Vague language can lead to confusion and disputes later.

-

Choosing the Wrong Agent: Selecting an agent who lacks the necessary skills or trustworthiness can be detrimental. It’s crucial to choose someone who understands your wishes and can act in your best interest.

-

Not Signing the Document: A Power of Attorney form is not valid unless it is signed. Many people forget this step, rendering the document useless. Always double-check that all required signatures are present.

-

Ignoring Witness and Notary Requirements: South Dakota requires certain forms to be witnessed and notarized. Skipping these steps can invalidate the document. Be sure to follow all legal requirements for execution.

-

Failing to Update the Document: Life changes, and so do your needs. Not revising the Power of Attorney when circumstances change—like a new relationship or health condition—can lead to complications.

-

Not Discussing with the Agent: It’s important to have a conversation with your chosen agent about your wishes and expectations. Failing to do so can lead to misunderstandings and decisions that do not align with your desires.

Key takeaways

When dealing with the South Dakota Power of Attorney form, it's essential to understand its significance and the details involved in its completion. Here are some key takeaways to consider:

- Purpose: A Power of Attorney allows you to designate someone to make decisions on your behalf, particularly in financial or legal matters.

- Types: South Dakota recognizes several types of Power of Attorney, including general, limited, and durable, each serving different needs.

- Principal and Agent: The person granting authority is the principal, while the individual receiving authority is the agent or attorney-in-fact.

- Capacity: The principal must be mentally competent when signing the form to ensure that the document is valid.

- Signature Requirements: The Power of Attorney must be signed by the principal and may require notarization to be legally binding.

- Revocation: A principal can revoke the Power of Attorney at any time, as long as they are competent to do so.

- Agent’s Duties: The agent must act in the best interest of the principal and follow their instructions, adhering to a fiduciary duty.

- Limitations: The form can specify limitations on the agent’s authority, which should be clearly outlined to avoid confusion.

- State-Specific Rules: Always check for any state-specific rules or requirements that may affect the Power of Attorney in South Dakota.

- Consultation: It’s advisable to consult with a legal professional to ensure that the Power of Attorney meets your needs and complies with state laws.

Understanding these aspects can help ensure that the Power of Attorney is executed properly and serves its intended purpose effectively.