Free South Dakota Operating Agreement Document

The South Dakota Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the internal rules and regulations governing the management and operation of the LLC. Key aspects include the distribution of profits and losses among members, the roles and responsibilities of managers, and the procedures for admitting new members or handling the departure of existing ones. Additionally, the agreement may address voting rights and decision-making processes, ensuring that all members are on the same page regarding the governance of the company. By clearly defining these elements, the Operating Agreement helps to prevent misunderstandings and disputes among members, ultimately promoting a smoother operational framework for the LLC. Understanding the intricacies of this form is essential for anyone looking to establish or manage a limited liability company in South Dakota.

Fill out Other Popular Forms for South Dakota

Warranty Deed South Dakota - Use this Deed to create a permanent record of property ownership transfer.

Selling a Vehicle in South Dakota - This form can provide peace of mind through documented agreements.

For those seeking clarity in real estate dealings, understanding the intricacies of a thorough Florida Lease Agreement is crucial. This document ensures both landlords and tenants are fully aware of their rights and responsibilities, helping to foster a transparent renting experience.

South Dakota Divorce Laws Adultery - A Divorce Settlement Agreement is crucial for a legally binding resolution.

File Specifics

| Fact Name | Description |

|---|---|

| Purpose | The South Dakota Operating Agreement form outlines the management structure and operational procedures of a limited liability company (LLC) in South Dakota. |

| Governing Law | This form is governed by the South Dakota Codified Laws, specifically Title 47, Chapter 34A, which pertains to limited liability companies. |

| Members' Rights | It establishes the rights and responsibilities of the members, including profit sharing, voting rights, and decision-making processes. |

| Flexibility | The Operating Agreement allows for customization, enabling members to tailor the agreement to fit their specific needs and preferences. |

| Importance | Having an Operating Agreement is crucial for protecting the interests of members and providing clarity in operations, especially in disputes. |

Guidelines on How to Fill Out South Dakota Operating Agreement

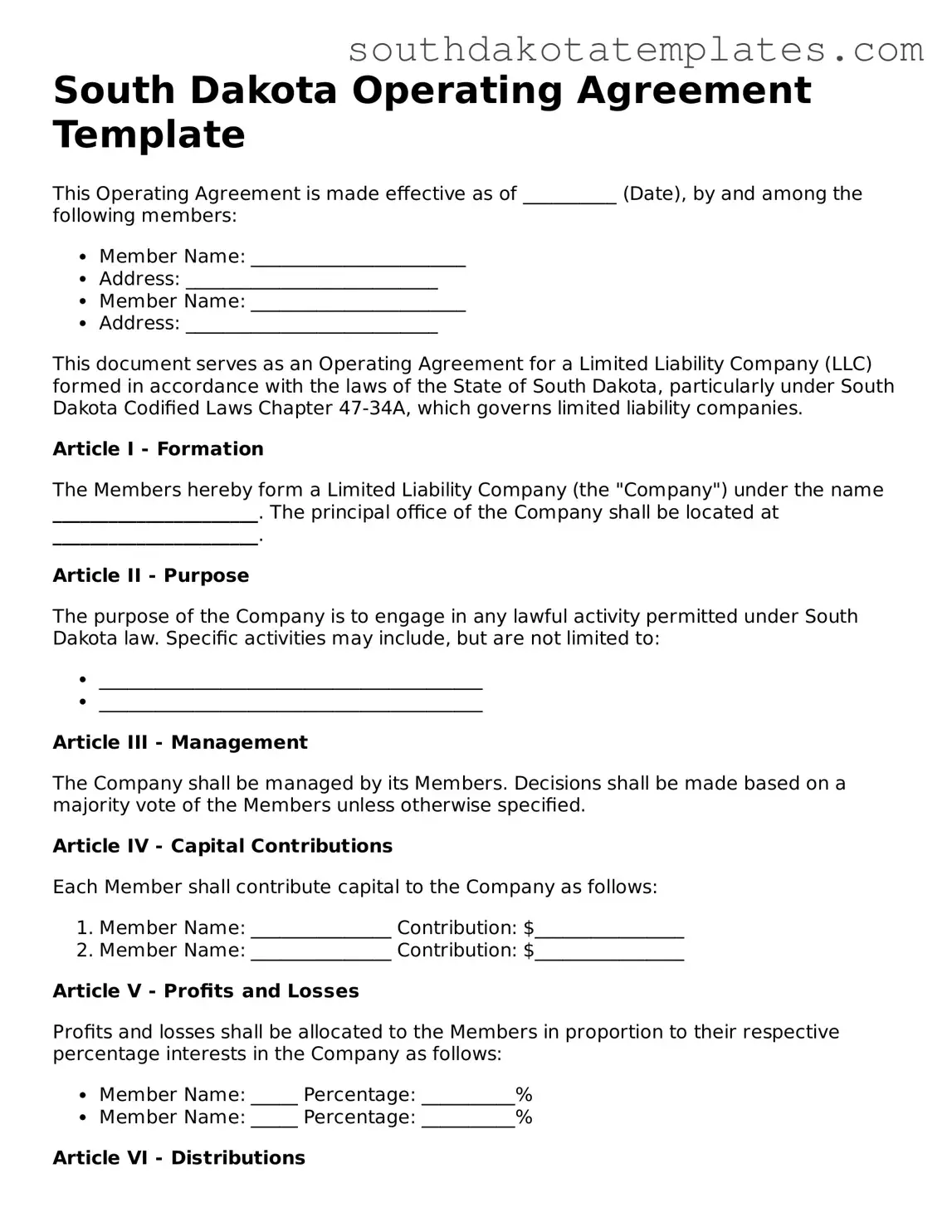

Once you have the South Dakota Operating Agreement form in hand, you will need to carefully complete it to ensure it accurately reflects your business structure and intentions. This document is essential for outlining the management and operational procedures of your business. Follow these steps to fill out the form correctly.

- Begin by entering the name of your business at the top of the form. Make sure it matches the name registered with the state.

- Next, provide the principal office address. This should be a physical address where your business operates.

- Identify the members of the LLC. List each member's name and address clearly. If there are multiple members, ensure all are included.

- Indicate the percentage of ownership for each member. This reflects their stake in the business and should total 100%.

- Outline the management structure. Specify whether the LLC will be managed by its members or by appointed managers.

- Detail the voting rights of each member. Clearly state how decisions will be made and what constitutes a quorum for meetings.

- Include provisions for profit and loss distribution. Specify how profits and losses will be allocated among members.

- Address the process for adding or removing members. This is important for future changes in the business structure.

- Sign and date the form. All members should review the document and sign to indicate their agreement.

After completing the form, you will need to keep it in your business records. It’s advisable to consult with a legal professional to ensure that all aspects of the agreement meet your needs and comply with state regulations.

Misconceptions

Understanding the South Dakota Operating Agreement form is crucial for anyone involved in a business partnership or limited liability company (LLC) in the state. However, several misconceptions can lead to confusion. Here are ten common misunderstandings about this important document:

- It is not necessary for all LLCs. Some believe that an operating agreement is optional for LLCs. In South Dakota, while it is not legally required, having one is highly recommended to outline the management structure and operational procedures.

- It must be filed with the state. Many think that the operating agreement needs to be submitted to the state government. In reality, it is an internal document and does not require filing.

- All members must sign it. Some assume that only the managing member needs to sign the agreement. However, all members should sign to ensure everyone agrees to the terms outlined.

- It can only be changed with a formal amendment. There is a belief that once the operating agreement is created, it cannot be modified without a formal amendment. In fact, members can agree to changes informally, but it’s best to document any modifications in writing.

- It is the same as the Articles of Organization. Some confuse the operating agreement with the Articles of Organization. The Articles of Organization are filed with the state to create the LLC, while the operating agreement governs its internal operations.

- It is only for multi-member LLCs. A misconception exists that single-member LLCs do not need an operating agreement. Even a single-member LLC benefits from having one to clarify management and liability issues.

- It cannot address financial matters. Some believe that operating agreements cannot cover financial aspects. In reality, they can and should address how profits and losses are distributed among members.

- It is a static document. There is a notion that the operating agreement is set in stone. In truth, it should evolve as the business grows and changes, reflecting current practices and agreements.

- It has no legal standing. Some think that an operating agreement lacks legal enforceability. However, it is a binding contract among members and can be enforced in court.

- It is only for large businesses. Many believe that only larger businesses need an operating agreement. In fact, any LLC, regardless of size, can benefit from having clear guidelines and expectations outlined in an operating agreement.

Addressing these misconceptions is essential for ensuring that all members understand their rights and responsibilities. A well-crafted operating agreement can help prevent disputes and provide clarity in the operation of the LLC.

Documents used along the form

When forming a business entity in South Dakota, particularly a Limited Liability Company (LLC), the Operating Agreement is a crucial document. However, it is often accompanied by other important forms and documents that help establish the structure, governance, and operational procedures of the LLC. Understanding these documents can ensure that your business is set up correctly and operates smoothly.

- Articles of Organization: This is the foundational document that officially establishes your LLC with the state. It includes basic information such as the LLC's name, address, and the names of its members.

- Employer Identification Number (EIN) Application: This form is required to obtain an EIN from the IRS, which is necessary for tax purposes and to open a business bank account.

- Membership Certificates: These documents serve as proof of ownership in the LLC. They outline each member's percentage of ownership and can be used for various legal purposes.

- Initial Resolutions: These resolutions are formal documents that record important decisions made by the members at the formation of the LLC, such as the appointment of officers or the opening of bank accounts.

- Bylaws: While not always required, bylaws outline the internal rules and procedures for managing the LLC. They cover topics like voting rights and meeting protocols.

- Operating Procedures: This document details the day-to-day operational guidelines of the LLC, including roles and responsibilities of members and managers.

- Lease Agreement: A smarttemplates.net form is essential for formalizing rental agreements, outlining responsibilities, and protecting both landlords and tenants in the leasing process.

- Member Agreements: These agreements clarify the terms of membership, including capital contributions, profit sharing, and exit strategies for members.

- Annual Reports: In South Dakota, LLCs must file annual reports to maintain good standing. This document updates the state on the LLC's activities and current members.

- State-Specific Licenses and Permits: Depending on the nature of the business, additional licenses or permits may be necessary to operate legally in South Dakota.

- Tax Registration Forms: These forms are needed to register for state taxes, ensuring compliance with South Dakota tax laws.

Each of these documents plays a vital role in the successful formation and operation of an LLC in South Dakota. Ensuring that all necessary paperwork is completed accurately and submitted on time can prevent future legal complications and pave the way for a thriving business. Take the time to gather and understand these forms to set your LLC up for success.

Common mistakes

-

Incomplete Information: Failing to provide all required details can lead to delays or rejection of the agreement.

-

Incorrect Names: Using incorrect or misspelled names for members can create legal complications.

-

Missing Signatures: Not signing the agreement or having all members sign can invalidate the document.

-

Not Dated: Omitting the date of signing can lead to disputes about when the agreement was executed.

-

Ignoring State Requirements: Each state has specific requirements; failing to adhere to South Dakota's regulations can cause issues.

-

Inconsistent Terms: Using terms that conflict with each other can create confusion regarding the rights and responsibilities of members.

-

Not Including a Purpose Statement: Omitting the business purpose can lead to misunderstandings about the entity's goals.

-

Improperly Defined Roles: Failing to clearly outline the roles and responsibilities of each member can result in operational challenges.

-

Neglecting to Update: Not revising the agreement after significant changes in membership or business structure can render it outdated.

-

Overlooking Dispute Resolution: Not including a method for resolving disputes can lead to prolonged conflicts among members.

Key takeaways

Filling out and using the South Dakota Operating Agreement form is an important step for any business owner. Here are some key takeaways to consider:

- Clarity of Roles: Clearly define the roles and responsibilities of each member. This helps prevent misunderstandings and ensures everyone knows their duties.

- Profit Distribution: Specify how profits and losses will be shared among members. This can help avoid disputes in the future.

- Decision-Making Process: Outline how decisions will be made within the company. Whether by majority vote or unanimous consent, having a clear process is essential.

- Amendments and Changes: Include a section on how the agreement can be amended. Flexibility is important as the business grows and changes.