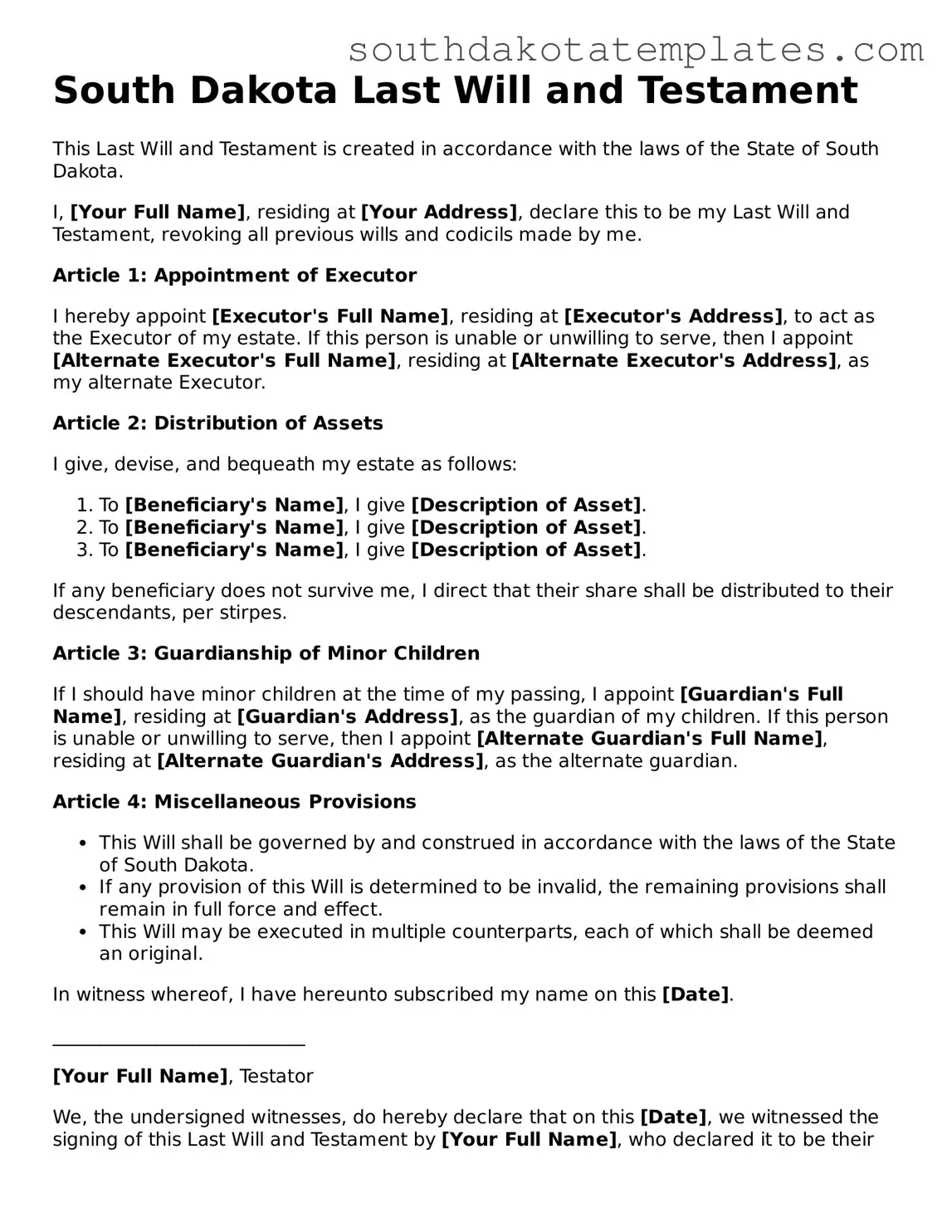

Free South Dakota Last Will and Testament Document

Creating a Last Will and Testament is a crucial step in ensuring that your wishes are honored after your passing. In South Dakota, this legal document serves as a roadmap for the distribution of your assets and the care of any dependents. The form outlines how your property should be divided among heirs, names an executor to manage the estate, and can even designate guardians for minor children. It is important to ensure that the will meets state-specific requirements to be considered valid, which includes being signed by the testator and witnessed appropriately. Understanding the nuances of the South Dakota Last Will and Testament form can help individuals navigate the complexities of estate planning, providing peace of mind that their affairs will be handled according to their desires. Additionally, the form allows for modifications and revocations, giving you the flexibility to adapt your wishes as circumstances change over time. By taking the time to prepare this document, you not only protect your legacy but also ease the burden on your loved ones during a difficult time.

Fill out Other Popular Forms for South Dakota

Selling a Vehicle in South Dakota - This form provides a legal reference if issues arise after the sale.

Having a clear and concise Operating Agreement is essential for any LLC, as it lays the groundwork for the operational framework and member dynamics. By following best practices and templates found at TopTemplates.info, businesses can ensure that their agreement is comprehensive and tailored to their specific needs, ultimately promoting better governance and reducing potential disputes.

What Is a Hold Harmless Agreement - The agreement helps to prevent future claims related to negligence or accidents.

File Specifics

| Fact Name | Details |

|---|---|

| Governing Law | The South Dakota Last Will and Testament is governed by South Dakota Codified Laws, Title 29A. |

| Minimum Age | Testators must be at least 18 years old to create a valid will in South Dakota. |

| Witness Requirement | The will must be signed by at least two witnesses who are present at the same time. |

| Revocation | A will can be revoked by creating a new will or by physically destroying the original document. |

| Self-Proving Will | South Dakota allows for self-proving wills, which can simplify the probate process. |

| Property Distribution | The will outlines how the testator's property and assets will be distributed after death. |

| Executor Appointment | The testator can appoint an executor to manage the estate and ensure the will's terms are carried out. |

| Holographic Wills | Holographic wills, which are handwritten and signed by the testator, are recognized in South Dakota. |

Guidelines on How to Fill Out South Dakota Last Will and Testament

Once you have obtained the South Dakota Last Will and Testament form, it is essential to complete it accurately. This document allows you to outline your wishes regarding the distribution of your assets after your passing. Following the steps carefully will help ensure that your intentions are clear and legally valid.

- Begin by writing your full name at the top of the form. Ensure that you include any middle names or initials to avoid confusion.

- Next, provide your current address. This should be your primary residence where you live at the time of filling out the form.

- Clearly state the date on which you are completing the will. This is important for legal purposes.

- Designate an executor. This is the person you choose to carry out the terms of your will. Write their full name and address.

- List your beneficiaries. These are the individuals or organizations who will receive your assets. Include their full names and relationships to you.

- Detail the specific assets you wish to bequeath to each beneficiary. Be as clear and specific as possible to avoid any misunderstandings.

- Include any additional instructions or wishes you may have regarding your estate. This can cover matters like funeral arrangements or guardianship for minor children.

- Sign the document in the presence of at least two witnesses. They should also sign the will, affirming that they witnessed you signing it.

- Finally, store the completed will in a safe place. Inform your executor and close family members where it can be found when needed.

Misconceptions

When it comes to creating a Last Will and Testament in South Dakota, several misconceptions can lead to confusion. Understanding these common myths is essential for anyone looking to ensure their wishes are honored after their passing.

- A handwritten will is not valid. Many believe that a will must be typed to be legally binding. In South Dakota, a handwritten will, also known as a holographic will, can be valid if it is signed by the testator and the material provisions are in their handwriting.

- Only wealthy individuals need a will. This misconception overlooks the fact that everyone can benefit from having a will, regardless of their financial situation. A will allows individuals to dictate how their assets, regardless of size, will be distributed, ensuring that their wishes are respected.

- Wills are only for older adults. While it is true that many older adults create wills, younger individuals should also consider having one. Life is unpredictable, and having a will can provide peace of mind at any age, particularly for those with dependents or specific wishes for their assets.

- Once created, a will cannot be changed. This is a common misunderstanding. In South Dakota, individuals can amend their wills as needed. Changes can be made through a codicil, which is a document that modifies the original will, or by creating an entirely new will.

- A will is sufficient for all estate planning needs. While a will is an important component of estate planning, it may not cover all aspects. Individuals may also need to consider trusts, powers of attorney, and healthcare directives to ensure comprehensive planning for their future and their loved ones.

Documents used along the form

When preparing a Last Will and Testament in South Dakota, it's essential to consider other important documents that complement your will. Each of these documents serves a unique purpose in ensuring that your wishes are honored and your loved ones are taken care of. Below is a list of some common forms and documents that often accompany a will.

- Durable Power of Attorney: This document allows you to designate someone to make financial and legal decisions on your behalf if you become incapacitated. It provides peace of mind knowing that someone you trust will manage your affairs.

- Healthcare Power of Attorney: Similar to a durable power of attorney, this document specifically grants someone the authority to make medical decisions for you if you are unable to do so. It ensures your healthcare preferences are respected.

- Living Will: A living will outlines your wishes regarding medical treatment in situations where you may not be able to communicate your desires. This document is vital for guiding your loved ones and healthcare providers in making decisions aligned with your values.

- Revocable Living Trust: A revocable living trust can help manage your assets during your lifetime and distribute them after your death without going through probate. This can simplify the process for your beneficiaries and maintain privacy.

- Beneficiary Designations: Certain assets, such as life insurance policies and retirement accounts, allow you to name beneficiaries directly. Keeping these designations updated ensures that your assets go to the intended recipients without complications.

- Florida Lease Agreement Form: To ensure clarity in rental arrangements, consider reviewing our detailed Florida lease agreement form template to facilitate a smooth leasing process.

- Letter of Instruction: While not a legal document, a letter of instruction can accompany your will. It provides additional guidance to your executor and loved ones regarding your wishes, including funeral arrangements and the location of important documents.

- Asset Inventory List: Creating an inventory of your assets helps your executor understand what you own. This list can simplify the estate administration process and ensure that nothing is overlooked.

- Guardianship Designation: If you have minor children, this document allows you to specify who you would like to care for them in the event of your passing. It is crucial for ensuring that your children are raised by someone you trust.

- Affidavit of Heirship: This document can help establish the heirs of your estate, especially if you die without a will. It provides a legal declaration of who your heirs are, which can facilitate the transfer of assets.

Incorporating these documents into your estate planning can create a comprehensive strategy for your future and the future of your loved ones. Each document plays a crucial role in ensuring that your wishes are respected and that your family is protected, making the planning process a vital step in securing peace of mind.

Common mistakes

-

Not clearly identifying the testator: Failing to include the full legal name and address can lead to confusion about the individual making the will.

-

Omitting witnesses: Many people forget to have the will signed in the presence of witnesses, which is a requirement in South Dakota for the will to be valid.

-

Inadequate asset description: Listing assets without sufficient detail can create ambiguity. It's important to specify what is being bequeathed and to whom.

-

Failing to update the will: Life changes, such as marriage, divorce, or the birth of children, necessitate updates to the will. Neglecting this can lead to outdated provisions.

-

Not revoking previous wills: If a new will is created without formally revoking previous ones, conflicts may arise regarding which will is valid.

-

Ignoring the self-proving affidavit: South Dakota allows for a self-proving affidavit, which can simplify the probate process. Not including this can lead to complications later.

-

Using unclear language: Ambiguous terms can lead to misinterpretation. Clear and straightforward language should be used to avoid disputes among heirs.

-

Not considering tax implications: Failing to understand potential estate taxes can result in unintended financial burdens on heirs. Consulting with a financial advisor is advisable.

Key takeaways

Creating a Last Will and Testament in South Dakota is an important step in ensuring that your wishes are honored after your passing. Here are some key takeaways to consider when filling out and using this legal document:

- Understand the Requirements: South Dakota law has specific requirements for a valid will. It must be in writing, signed by you, and witnessed by at least two individuals who are not beneficiaries.

- Be Clear and Specific: Clearly outline your wishes regarding the distribution of your assets. This clarity helps avoid confusion and potential disputes among your heirs.

- Review and Update Regularly: Life circumstances change. Regularly review your will to ensure it reflects your current wishes, especially after major life events such as marriage, divorce, or the birth of a child.

- Consider Professional Guidance: While it is possible to create a will on your own, seeking advice from a legal professional can provide peace of mind. They can help ensure that your will complies with state laws and effectively communicates your intentions.