Free South Dakota General Power of Attorney Document

In South Dakota, a General Power of Attorney (GPOA) serves as a crucial legal document that empowers an individual, known as the principal, to designate another person, referred to as the agent, to manage their financial and legal affairs. This form is particularly valuable for those who may wish to ensure their interests are protected in situations where they are unable to make decisions themselves, such as during illness or extended travel. The GPOA grants the agent broad authority, allowing them to handle a wide range of tasks, from managing bank accounts and paying bills to making investment decisions and filing taxes. Importantly, the principal can specify limitations or conditions on the agent's powers, tailoring the document to fit their unique needs. While the GPOA is effective immediately upon signing, it can also include provisions that make it effective only under certain circumstances, such as incapacitation. Understanding the nuances of this form is essential for anyone considering its use, as it not only facilitates smooth management of affairs but also provides peace of mind for the principal and their loved ones.

Fill out Other Popular Forms for South Dakota

What Is a Hold Harmless Agreement - This form can provide peace of mind by limiting potential legal disputes.

When engaging in a boat sale, it is imperative to utilize a California Boat Bill of Sale form, as this legal document not only records the transaction but also protects both buyers and sellers from any future disputes. For those looking for a reliable template, you can find one at toptemplates.info/bill-of-sale/boat-bill-of-sale/california-boat-bill-of-sale/, ensuring a clear and structured agreement is established.

South Dakota Power of Attorney for Vehicle Transactions - Provide peace of mind by designating someone to manage your vehicle affairs.

File Specifics

| Fact Name | Description |

|---|---|

| Definition | A South Dakota General Power of Attorney form allows an individual to appoint someone to manage their financial and legal affairs. |

| Governing Law | The form is governed by South Dakota Codified Laws, specifically Title 59, Chapter 12. |

| Durability | This type of power of attorney can be durable, meaning it remains effective even if the principal becomes incapacitated. |

| Agent Authority | The agent can perform a variety of tasks, including handling bank transactions, managing real estate, and making legal decisions. |

| Revocation | The principal can revoke the power of attorney at any time, as long as they are mentally competent. |

| Signature Requirements | The form must be signed by the principal and witnessed by at least two individuals or notarized. |

| Limitations | Some actions, such as making a will or altering a trust, cannot be delegated through this form. |

| Effective Date | The power of attorney can be effective immediately upon signing or can be set to begin at a future date or event. |

Guidelines on How to Fill Out South Dakota General Power of Attorney

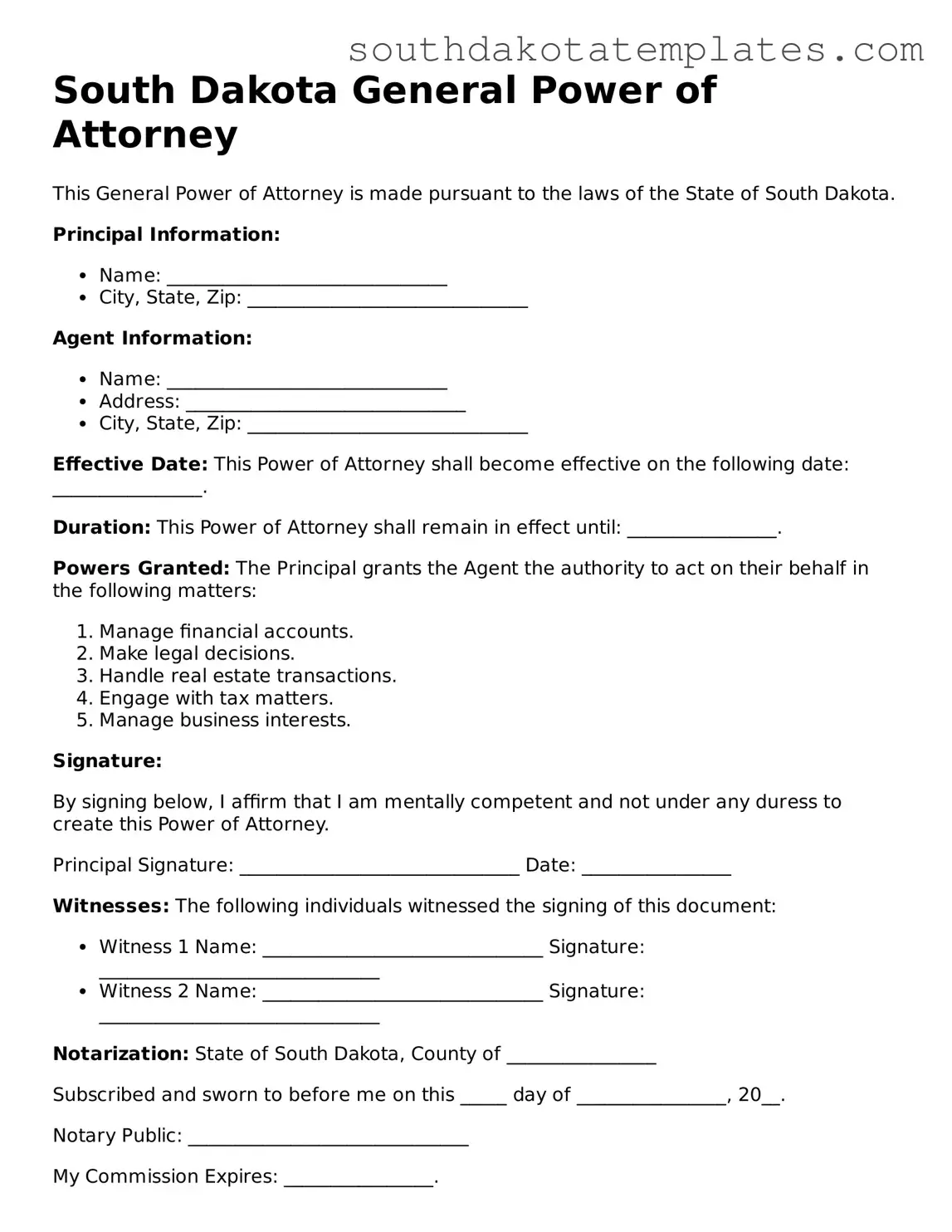

Filling out the South Dakota General Power of Attorney form requires careful attention to detail. Once completed, this document allows you to appoint someone to make decisions on your behalf. Follow these steps to ensure that the form is filled out correctly.

- Obtain the South Dakota General Power of Attorney form. You can find it online or at your local courthouse.

- Begin by entering your name and address in the designated fields. This information identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Clearly specify the powers you are granting to your agent. You can choose general powers or limit them to specific actions.

- Include the date when the powers will begin. This can be immediately or at a future date.

- Sign and date the form in the presence of a notary public. This step is crucial for the document's validity.

- Ensure that your agent also signs the form, acknowledging their acceptance of the responsibilities.

- Keep a copy of the completed form for your records. It’s important to have this document accessible in case it is needed.

Once you have completed these steps, you will have a valid General Power of Attorney form ready for use. Make sure to discuss your wishes with your agent to ensure they understand their responsibilities.

Misconceptions

When it comes to the South Dakota General Power of Attorney (GPOA), misunderstandings abound. Here are ten common misconceptions that people often have about this important legal document.

-

It only applies to financial matters.

Many believe that a GPOA is limited to financial decisions. In reality, it can also cover health care decisions, property management, and more, depending on how it’s drafted.

-

It remains effective even after I become incapacitated.

This is not true. A standard GPOA typically becomes invalid if the principal becomes incapacitated. However, a durable power of attorney can remain effective in such situations.

-

Anyone can be my agent.

While you can choose almost anyone to be your agent, it’s wise to select someone you trust deeply. This person will have significant authority over your affairs.

-

It’s only necessary for the elderly.

People often think that only seniors need a GPOA. However, unexpected events can happen at any age, making it beneficial for adults of all ages to have one in place.

-

Once it’s signed, it can’t be changed.

This is a misconception. A GPOA can be revoked or modified at any time, as long as the principal is mentally competent.

-

It must be notarized to be valid.

While notarization adds an extra layer of authenticity, a GPOA can still be valid without it, provided it meets the state’s requirements.

-

My agent can do anything they want with my assets.

This is misleading. An agent must act in your best interest and follow the guidelines set forth in the GPOA. They cannot use your assets for personal gain.

-

It automatically expires after a certain period.

There is no set expiration date for a GPOA unless specified in the document itself. It remains effective until revoked or the principal passes away.

-

It’s only necessary if I have significant assets.

This is not the case. Even if you have modest assets, a GPOA can help manage your affairs during times of need.

-

Once I create a GPOA, I lose control over my decisions.

This is a common fear, but a GPOA is a tool that allows you to delegate decision-making. You retain control and can revoke the document whenever you choose.

Understanding these misconceptions can help individuals make informed decisions about their legal planning. A General Power of Attorney can be a valuable asset in managing your affairs, so it’s essential to grasp its true nature and function.

Documents used along the form

When individuals decide to establish a General Power of Attorney in South Dakota, they often consider additional documents that complement or enhance their estate planning and financial management strategies. Below is a list of forms and documents frequently used in conjunction with a General Power of Attorney.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. It ensures that the designated agent can continue to make decisions on behalf of the principal when they are unable to do so themselves.

- Living Will: A living will outlines an individual’s preferences regarding medical treatment in the event of a terminal illness or incapacitation. It provides guidance to healthcare providers and family members about the person’s wishes.

- Healthcare Power of Attorney: This form appoints someone to make medical decisions on behalf of the individual if they are unable to do so. It is crucial for ensuring that healthcare preferences are honored.

- Last Will and Testament: A legal document that details how a person's assets will be distributed upon their death, including appointing an executor to manage the estate and ensuring that final wishes are carried out. You can find templates at smarttemplates.net.

- Will: A will specifies how an individual's assets should be distributed upon their death. It can also designate guardians for minor children and provide instructions for final arrangements.

- Revocable Trust: A revocable trust allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after death. It can help avoid probate and maintain privacy.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for various accounts, such as life insurance policies or retirement accounts. They ensure that assets pass directly to the named individuals without going through probate.

- Financial Power of Attorney: Similar to a General Power of Attorney, this document specifically grants authority to manage financial matters. It can be tailored to cover a wide range of financial transactions.

- Property Transfer Documents: These documents facilitate the transfer of property ownership, whether real estate or personal property. They are essential for ensuring that assets are properly conveyed according to the principal’s wishes.

Incorporating these documents into estate planning not only provides clarity and direction but also safeguards an individual's preferences in various circumstances. By understanding the interplay of these forms, individuals can create a comprehensive plan that addresses both their financial and healthcare needs.

Common mistakes

-

Not specifying the powers granted: One common mistake is failing to clearly outline the specific powers being granted to the agent. This can lead to confusion and may limit the agent's ability to act effectively on behalf of the principal.

-

Using vague language: Some individuals use ambiguous terms or phrases that can be interpreted in multiple ways. It’s important to be precise to avoid misunderstandings.

-

Not including a durable clause: If the intent is for the power of attorney to remain effective even if the principal becomes incapacitated, a durable clause must be included. Omitting this can lead to the document becoming invalid at a critical time.

-

Failing to date the document: A common oversight is not dating the form. Without a date, it can be difficult to determine when the powers were granted, which can lead to disputes.

-

Not signing in front of a notary: In South Dakota, it is typically required to have the document notarized. Failing to do so can result in the document being considered invalid.

-

Neglecting to inform the agent: Some people complete the form without discussing it with the appointed agent. It’s crucial to ensure that the agent is aware of their responsibilities and is willing to accept them.

-

Forgetting to revoke previous powers of attorney: If there are existing power of attorney documents, it’s essential to revoke them explicitly. Otherwise, confusion may arise regarding which document is valid.

-

Not reviewing the document regularly: Life circumstances can change, and so can the needs for a power of attorney. Failing to review and update the document can lead to outdated information and ineffective representation.

Key takeaways

When filling out and using the South Dakota General Power of Attorney form, there are several important points to keep in mind. Understanding these can help ensure that the document serves its intended purpose effectively.

- Understand the Authority Granted: The General Power of Attorney allows you to appoint someone to make decisions on your behalf. This can include financial matters, property transactions, and other legal decisions.

- Choose Your Agent Wisely: Select a trustworthy individual as your agent. This person will have significant power over your affairs, so consider their reliability and judgment.

- Be Specific About Powers: While the form is general, you can specify certain powers or limitations. Clearly outlining what your agent can and cannot do can prevent misunderstandings.

- Consider Durability: A General Power of Attorney can be durable or non-durable. A durable power remains effective even if you become incapacitated, while a non-durable one does not.

- Sign and Notarize: To make the document legally binding, you must sign it in front of a notary public. This step is crucial for the form to be accepted by banks and other institutions.

- Review Regularly: Your circumstances may change over time. Regularly reviewing and updating the Power of Attorney ensures it continues to reflect your wishes and needs.