Free South Dakota Durable Power of Attorney Document

In South Dakota, the Durable Power of Attorney (DPOA) form serves as a crucial legal tool, empowering individuals to designate a trusted person to make decisions on their behalf when they are unable to do so. This document is particularly significant for planning ahead, as it remains effective even if the principal becomes incapacitated. The form outlines the specific powers granted to the agent, which can include managing financial matters, handling real estate transactions, and making healthcare decisions. It is essential for individuals to clearly articulate their wishes within the form to ensure their agent acts in accordance with their preferences. Additionally, the DPOA must be signed in the presence of a notary public to be legally valid, providing an added layer of security. Understanding the nuances of this form can help individuals navigate the complexities of future planning and ensure their interests are protected.

Fill out Other Popular Forms for South Dakota

South Dakota Prenup - Many couples choose to draft a prenup as a reflection of their values, such as fairness and transparency.

Which One of the Following Is Someone Who Authorizes Another to Act as Agent? - This document can save time and effort while managing ongoing financial matters.

When drafting a Lease Agreement, it is crucial to utilize reliable resources to ensure all necessary terms are included. For a comprehensive template, you can refer to smarttemplates.net, which offers fillable lease agreement forms designed to guide both landlords and tenants in establishing clear and enforceable rental terms.

South Dakota Rental Agreement - It serves as a guideline for what modifications can be made by the tenant.

File Specifics

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to designate someone to make decisions on their behalf if they become incapacitated. |

| Governing Law | The South Dakota Durable Power of Attorney is governed by South Dakota Codified Laws, Chapter 59-12. |

| Durability | This document remains effective even if the principal becomes incapacitated, which distinguishes it from a regular Power of Attorney. |

| Principal's Rights | The principal retains the right to revoke or modify the Durable Power of Attorney at any time while they are competent. |

| Agent's Authority | The agent can be granted broad or limited powers, depending on the principal's wishes as outlined in the document. |

| Witness Requirements | In South Dakota, the Durable Power of Attorney must be signed in the presence of two witnesses or a notary public to be valid. |

Guidelines on How to Fill Out South Dakota Durable Power of Attorney

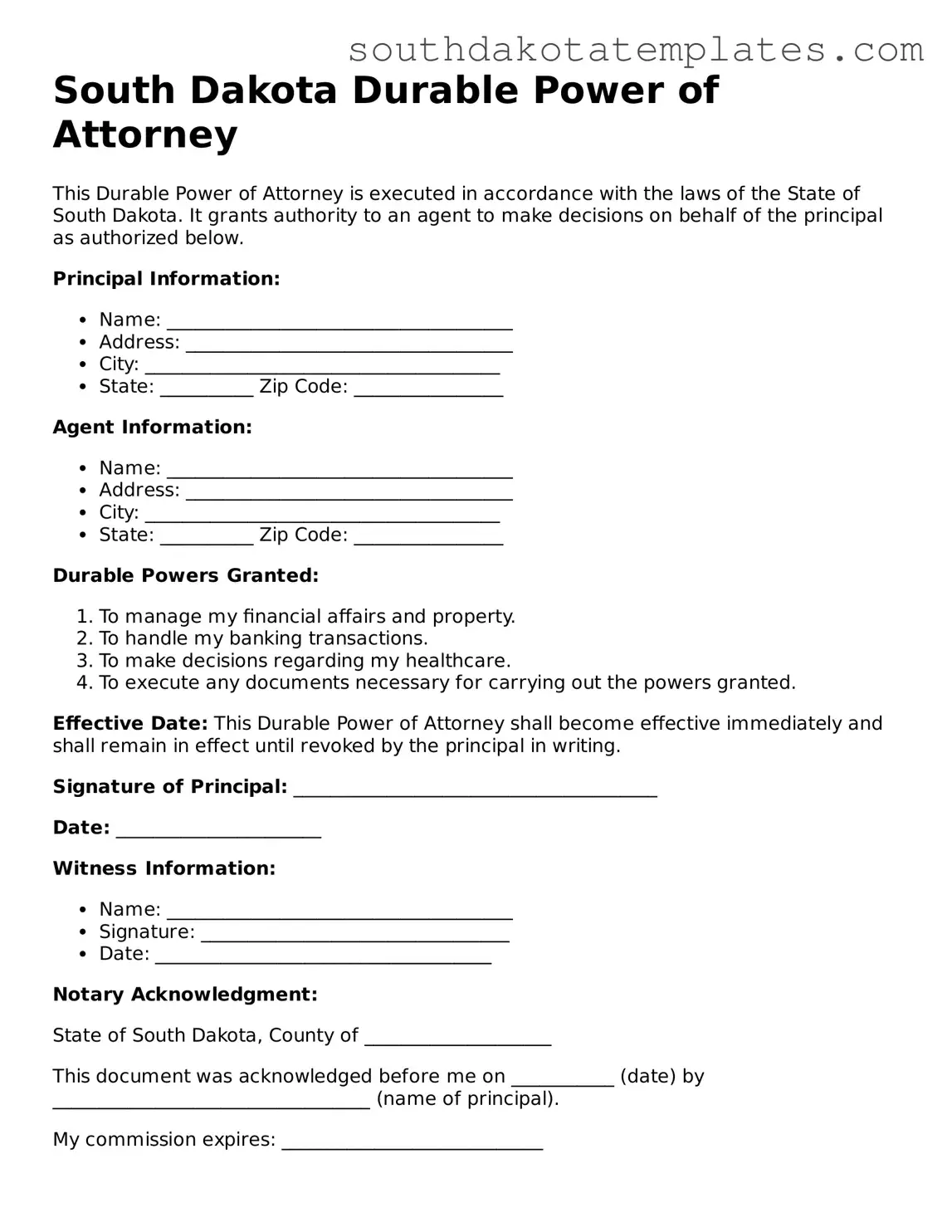

Filling out the South Dakota Durable Power of Attorney form is an important step in designating someone to make decisions on your behalf. After completing the form, you will need to sign it and ensure it is properly witnessed and notarized to make it legally binding.

- Obtain the South Dakota Durable Power of Attorney form. You can find it online or at legal offices.

- Read through the entire form to understand the sections that need to be completed.

- Fill in your full name and address in the designated areas as the principal.

- Identify the agent you are appointing. Write their full name and address clearly.

- Specify the powers you wish to grant to your agent. This may include financial, medical, or other decisions.

- Include any limitations or specific instructions regarding the powers granted, if applicable.

- Sign and date the form at the bottom. Make sure your signature matches the name you provided at the beginning.

- Have the form witnessed by two individuals who are not related to you and are not your agent.

- Notarize the document to ensure it meets legal requirements. Find a notary public and present your signed form.

- Keep the original document in a safe place and provide copies to your agent and any relevant parties.

Misconceptions

Understanding the South Dakota Durable Power of Attorney form is crucial for anyone considering this legal document. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- It only applies to financial matters. Many people believe that a Durable Power of Attorney is limited to financial decisions. In reality, it can also encompass healthcare and other personal matters, depending on how it is drafted.

- It becomes effective only when the principal is incapacitated. Some assume that the document only takes effect when the principal is unable to make decisions. However, it can be structured to be effective immediately upon signing, allowing the agent to act on behalf of the principal right away.

- It is the same as a regular Power of Attorney. While both documents grant authority to an agent, a Durable Power of Attorney remains valid even if the principal becomes incapacitated. A regular Power of Attorney does not have this feature.

- It can be used indefinitely without updates. Some individuals think that once the form is completed, it remains valid forever. However, changes in circumstances, such as the principal’s wishes or changes in law, may necessitate updates to the document.

- Anyone can be appointed as an agent. Many believe that any person can serve as an agent under a Durable Power of Attorney. While this is true, it is essential to choose someone trustworthy and capable of handling the responsibilities involved.

- It is only for older adults. A common misconception is that only seniors need a Durable Power of Attorney. In fact, anyone over the age of 18 can benefit from having one, as unexpected situations can arise at any age.

- It is a one-size-fits-all document. Some think that the same Durable Power of Attorney form works for everyone. However, each individual’s needs and preferences can vary significantly, making it important to tailor the document accordingly.

- It cannot be revoked once signed. Many people believe that once a Durable Power of Attorney is signed, it cannot be changed. In truth, the principal has the right to revoke or amend the document at any time, as long as they are competent to do so.

Clearing up these misconceptions can help individuals make informed decisions about their legal planning and ensure that their wishes are respected.

Documents used along the form

When considering a Durable Power of Attorney (DPOA) in South Dakota, it’s essential to understand that this document often works in conjunction with several other legal forms. Each of these documents serves a unique purpose and can provide additional clarity and support for your financial and healthcare decisions. Below are some commonly used forms alongside the DPOA.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment and appoints someone to make healthcare decisions on your behalf if you are unable to do so. It ensures your wishes are respected regarding medical interventions.

- Living Will: A living will specifies your wishes regarding end-of-life care. It addresses situations where you may be terminally ill or in a persistent vegetative state, providing guidance on whether to continue or withhold life-sustaining treatment.

- HIPAA Release Form: This form allows you to designate individuals who can access your medical records and health information. It is crucial for ensuring that your healthcare agent can make informed decisions based on your medical history.

- Financial Power of Attorney: Similar to a DPOA, this document grants another person the authority to handle your financial matters. While a DPOA may cover both financial and healthcare decisions, this form focuses specifically on financial transactions and obligations.

- Florida Lease Agreement: A clear Florida lease agreement template can help both landlords and tenants effectively outline rental terms and conditions.

- Will: A will outlines how you want your assets distributed after your death. It can also appoint guardians for minor children. Having a will complements a DPOA by ensuring your wishes regarding your estate are clear and legally binding.

Understanding these documents can help ensure that your wishes are honored and that your loved ones are equipped to make decisions on your behalf. It is advisable to consult with a legal professional to tailor these forms to your specific needs and circumstances.

Common mistakes

-

Not naming a reliable agent. Choosing someone who may not act in your best interest can lead to complications.

-

Failing to specify the powers granted. It’s crucial to clearly outline what decisions your agent can make on your behalf.

-

Neglecting to date the document. A date helps establish when the power of attorney takes effect.

-

Not signing in front of a notary. Many states, including South Dakota, require notarization for the document to be valid.

-

Forgetting to discuss your wishes with your agent. Open communication can prevent misunderstandings later on.

-

Leaving out alternate agents. If your primary agent cannot serve, having a backup is essential.

-

Using outdated forms. Always ensure you are using the most current version of the Durable Power of Attorney form.

-

Not reviewing the document periodically. Life changes, and so may your needs. Regular reviews can keep your plan relevant.

-

Assuming all agents have the same authority. Clearly defining roles and responsibilities can help avoid confusion.

-

Overlooking state-specific requirements. Each state has its own rules, and South Dakota is no exception.

Key takeaways

Filling out and using the South Dakota Durable Power of Attorney form is an important step in planning for the future. Here are some key takeaways to keep in mind:

- Understanding the Purpose: A Durable Power of Attorney allows you to appoint someone to make financial and legal decisions on your behalf if you become unable to do so. This ensures that your affairs are managed according to your wishes.

- Choosing the Right Agent: It is crucial to select a trustworthy and responsible person as your agent. This individual will have significant authority, so consider their ability to act in your best interest.

- Completing the Form: Ensure that all required sections of the Durable Power of Attorney form are filled out completely and accurately. Any missing information could lead to complications later on.

- Revocation and Updates: Remember that you can revoke or update your Durable Power of Attorney at any time, as long as you are still mentally competent. Keeping your documents current is essential for effective planning.