Free South Dakota Deed Document

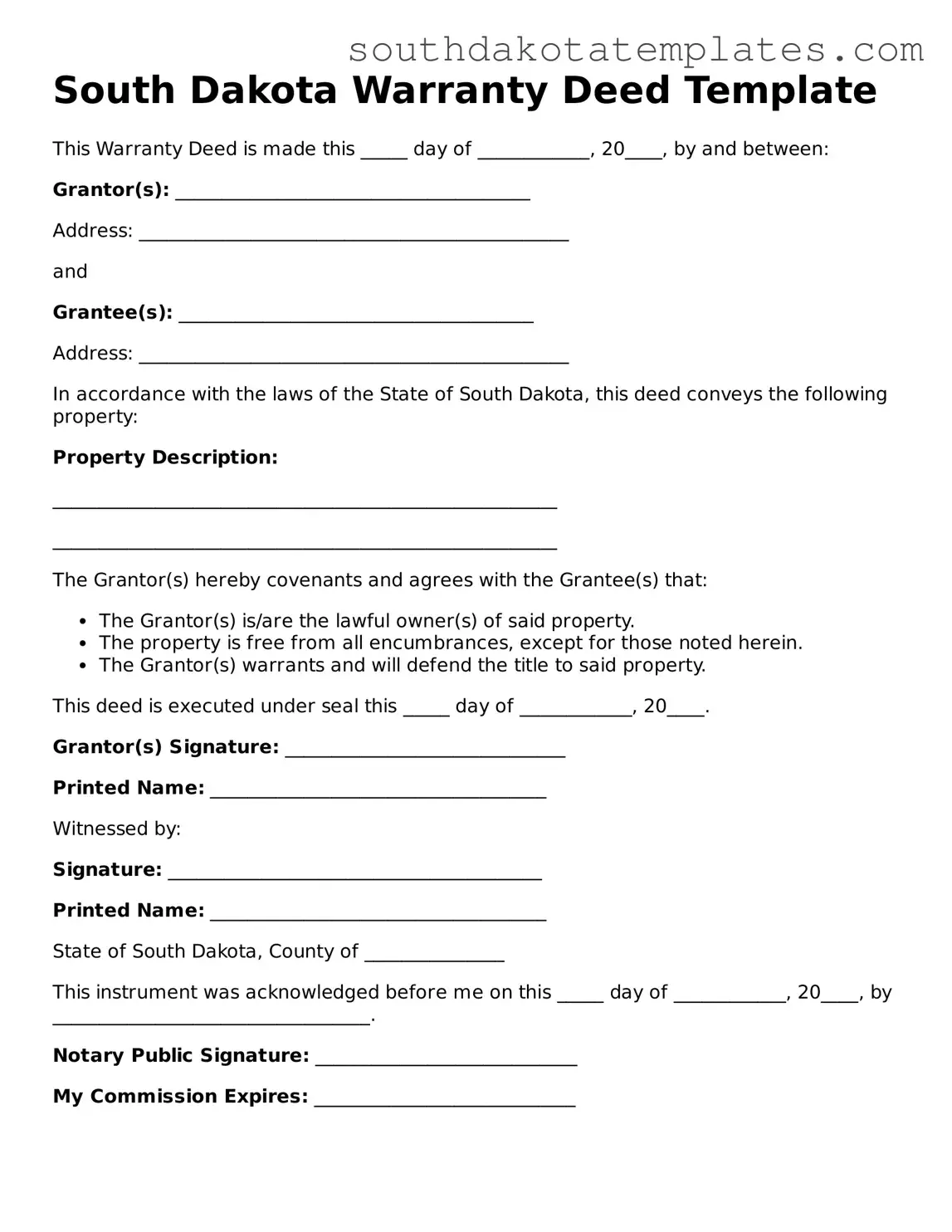

When it comes to transferring property ownership in South Dakota, understanding the Deed form is crucial. This legal document serves as the official record of the transfer, detailing essential information such as the names of the parties involved, the property description, and any conditions tied to the transfer. It is important to ensure that the form is filled out accurately to avoid complications down the line. The Deed must be signed and notarized to be valid, and it is typically recorded in the county where the property is located. Additionally, there are different types of Deeds, such as Warranty Deeds and Quitclaim Deeds, each serving specific purposes and offering varying levels of protection to the buyer. Knowing these distinctions can help in making informed decisions during a property transaction. Proper use of the South Dakota Deed form is not just a formality; it lays the groundwork for secure and lawful property ownership.

Fill out Other Popular Forms for South Dakota

Power of Attorney in Healthcare - A Durable Power of Attorney is effective even if you become mentally incompetent.

South Dakota Power of Attorney for Vehicle Transactions - This legal tool helps facilitate the buying or selling of vehicles.

Creating a comprehensive Last Will and Testament is crucial for ensuring your wishes are honored, and resources like smarttemplates.net can provide valuable templates to guide you through the process and make it easier to formalize your intentions.

Promissory Note Friendly Loan Agreement Format - It is often advisable for borrowers to review the terms carefully before signing.

File Specifics

| Fact Name | Description |

|---|---|

| Governing Law | The South Dakota Deed form is governed by South Dakota Codified Laws, specifically Chapter 43-4 regarding conveyances of real property. |

| Types of Deeds | South Dakota recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. |

| Recording Requirements | To be valid, the deed must be recorded with the county register of deeds in the county where the property is located. |

| Signature Requirements | The deed must be signed by the grantor, and it is recommended that the signature be notarized for authenticity. |

Guidelines on How to Fill Out South Dakota Deed

Filling out the South Dakota Deed form is an important step in transferring property ownership. After completing the form, it will need to be filed with the appropriate county office to ensure that the change in ownership is officially recorded. This process helps protect the rights of both the buyer and the seller.

- Obtain the Deed Form: Start by obtaining the South Dakota Deed form from a reliable source, such as a legal forms website or your local county office.

- Identify the Parties: Clearly write the names of the grantor (the person transferring the property) and the grantee (the person receiving the property). Ensure that the names are spelled correctly and match the names on their identification documents.

- Provide Property Description: Accurately describe the property being transferred. This includes the address, legal description, and any relevant details that identify the property clearly.

- Include Consideration: State the amount of money or other value exchanged for the property. This is known as the consideration and must be specified on the deed.

- Sign the Deed: The grantor must sign the deed in the presence of a notary public. This step is crucial for the deed to be legally binding.

- Notarization: After signing, the notary public will complete their section, verifying the identity of the grantor and witnessing the signature.

- Record the Deed: Finally, take the completed and notarized deed to the county recorder's office where the property is located. There, it will be officially recorded, making the transfer of ownership public.

Misconceptions

There are several misconceptions about the South Dakota Deed form that can lead to confusion. Here are seven common misunderstandings:

- All deeds are the same. Many believe that all deed forms serve the same purpose. In reality, different types of deeds, such as warranty deeds and quitclaim deeds, serve distinct legal functions.

- A deed must be notarized to be valid. While notarization is often required, it is not always necessary for a deed to be legally binding. Some deeds may be valid without a notary, depending on specific circumstances.

- Deeds can be verbal. Some think that a verbal agreement is enough to transfer property. However, property transfers must be documented in writing to be enforceable.

- All property transfers require a lawyer. While having legal assistance is beneficial, it is not mandatory for every property transfer. Individuals can complete a deed on their own if they understand the process.

- Once a deed is signed, it cannot be changed. Many believe that a deed is final once executed. In fact, it can be amended or revoked under certain conditions, depending on state laws.

- Deeds are only for selling property. Some people think deeds are only used in sales transactions. However, deeds can also be used for gifting property or transferring ownership without a sale.

- Property taxes are unaffected by the deed. There is a misconception that changing a deed does not impact property taxes. In truth, a change in ownership may lead to a reassessment of property taxes.

Understanding these misconceptions can help ensure that property transactions in South Dakota are handled correctly and efficiently.

Documents used along the form

In South Dakota, several documents often accompany the Deed form during property transactions. Each of these documents serves a specific purpose and helps ensure a smooth transfer of property ownership.

- Title Insurance Policy: This document protects the buyer against any claims or disputes regarding the property’s title. It verifies that the title is clear and free of any liens or encumbrances.

- Property Transfer Declaration: This form provides information about the property being transferred, including its value and any relevant details. It is often required for tax assessment purposes.

- Affidavit of Title: This sworn statement confirms that the seller holds clear title to the property and has the legal right to sell it. It may also disclose any potential issues related to the title.

- Boat Bill of Sale: For those involved in maritime transactions, a https://toptemplates.info/bill-of-sale/boat-bill-of-sale/california-boat-bill-of-sale/ is essential to document the sale and transfer of ownership of a boat, ensuring legal compliance and protection for both the buyer and seller.

- Closing Statement: This document outlines the financial details of the transaction, including the purchase price, closing costs, and any adjustments. It is reviewed and signed at the closing of the sale.

Understanding these additional documents can help individuals navigate the property transfer process more effectively. Each plays a vital role in ensuring that all parties are informed and protected throughout the transaction.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details can lead to delays or rejection. Ensure that all fields are filled out accurately.

-

Incorrect Legal Descriptions: A precise legal description of the property is crucial. Errors in this section can cause confusion or disputes later on.

-

Missing Signatures: All required parties must sign the deed. Omitting a signature can invalidate the document.

-

Improper Notarization: The deed must be notarized correctly. A notary public must witness the signing, and any mistakes in this process can render the deed unenforceable.

-

Incorrect Date: Ensure the date of signing is accurate. An incorrect date can create complications regarding the effective transfer of property.

-

Failure to Include Grantee Information: The grantee, or the person receiving the property, must be clearly identified. Missing this information can lead to legal issues.

-

Not Following Local Requirements: Different counties may have specific requirements for deeds. Always check local regulations to avoid mistakes.

-

Overlooking Tax Implications: Not considering potential tax consequences can be a costly mistake. Consult with a tax professional to understand any obligations.

-

Neglecting to Keep Copies: After filing the deed, it is vital to keep copies for personal records. This helps in future transactions or disputes.

Key takeaways

When it comes to filling out and using the South Dakota Deed form, there are several important points to keep in mind. Understanding these can help ensure that your property transfer goes smoothly and is legally sound.

- Accuracy is Crucial: Make sure all names, addresses, and property descriptions are correct. Even a small error can lead to complications down the line.

- Signatures Matter: The deed must be signed by the grantor (the person transferring the property). In some cases, a notary public may also need to witness the signature.

- Recording the Deed: After filling out the deed, it’s essential to file it with the appropriate county office. This step is necessary to make the transfer official and to protect your ownership rights.

- Consulting Professionals: If you’re unsure about any part of the process, consider seeking advice from a real estate attorney or a qualified professional. Their expertise can help avoid potential pitfalls.

By keeping these key takeaways in mind, you can navigate the process of using the South Dakota Deed form with greater confidence and clarity.