Free South Dakota Bill of Sale Document

The South Dakota Bill of Sale form serves as a vital document in the transfer of ownership for various types of personal property, including vehicles, boats, and equipment. This form not only provides legal protection for both the buyer and the seller but also ensures that the transaction is documented clearly and accurately. Essential elements of the Bill of Sale include the names and addresses of both parties, a detailed description of the item being sold, the purchase price, and the date of the transaction. Additionally, it may contain information regarding any warranties or guarantees, which can help prevent disputes in the future. By utilizing this form, individuals can establish a clear record of ownership transfer, which is particularly important for items that require registration, such as motor vehicles. Understanding the importance of this document can help facilitate smoother transactions and foster trust between parties involved in the sale.

Fill out Other Popular Forms for South Dakota

South Dakota Divorce Laws Property Division - A resource for couples looking to separate amicably.

When engaging in a transaction, it's crucial to utilize a General Bill of Sale form to formalize the exchange of personal property. This document not only protects the interests of both the buyer and seller but also serves as an official record of the sale. For those looking to create a bill of sale, resources are available online, such as smarttemplates.net, which offer templates to simplify this process.

How to Become a Resident of South Dakota - A necessary step for various legal transactions.

File Specifics

| Fact Name | Details |

|---|---|

| Definition | A Bill of Sale is a legal document that transfers ownership of personal property from one party to another. |

| Governing Law | The Bill of Sale in South Dakota is governed by South Dakota Codified Laws § 43-41. |

| Types of Property | This form can be used for various types of personal property, including vehicles, equipment, and furniture. |

| Notarization | While notarization is not mandatory, it is highly recommended to enhance the document's validity. |

| Consideration | The Bill of Sale should specify the consideration (payment) exchanged for the property. |

| Buyer and Seller Information | Both the buyer and seller's names, addresses, and signatures must be included in the document. |

| Condition of Property | The form should describe the condition of the property being sold, including any warranties or disclaimers. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records. |

| Legal Protection | A properly completed Bill of Sale provides legal protection for both the buyer and seller in case of disputes. |

Guidelines on How to Fill Out South Dakota Bill of Sale

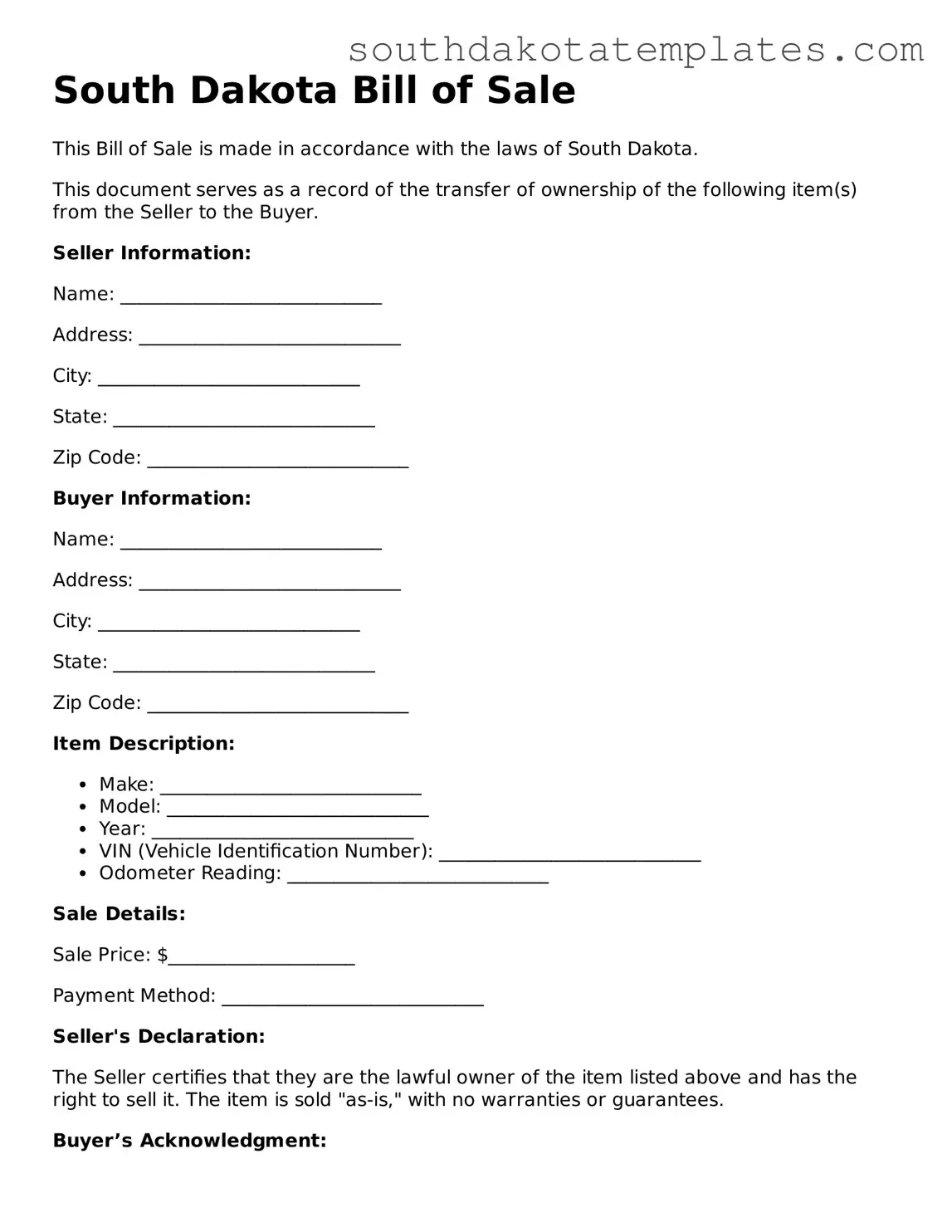

Once you have the South Dakota Bill of Sale form in hand, it’s time to fill it out accurately. This form is essential for documenting the sale of personal property, such as a vehicle or equipment. By completing it correctly, you ensure that both the buyer and seller have a clear understanding of the transaction.

- Begin by entering the date of the sale at the top of the form.

- Next, fill in the names and addresses of both the seller and the buyer. Make sure to include full names and current addresses to avoid any confusion.

- In the designated section, provide a detailed description of the item being sold. Include information such as the make, model, year, and VIN for vehicles, or any relevant details for other types of property.

- Indicate the sale price clearly. This is the amount agreed upon by both parties for the transaction.

- If applicable, note any warranties or guarantees associated with the sale. This helps clarify what the buyer can expect regarding the condition of the item.

- Both the seller and the buyer should sign and date the form at the bottom. This signature confirms that both parties agree to the terms outlined in the Bill of Sale.

- Finally, make copies of the completed form for both the seller and the buyer. Keeping a record is important for future reference.

Misconceptions

Many people hold misconceptions about the South Dakota Bill of Sale form. Understanding the facts can help ensure a smoother transaction process. Here are six common misconceptions:

-

It is only necessary for vehicle sales.

While commonly associated with vehicles, a Bill of Sale can be used for various types of personal property transactions, including boats, trailers, and even furniture.

-

It must be notarized to be valid.

A Bill of Sale does not require notarization in South Dakota to be legally binding. However, having it notarized can provide an extra layer of protection for both parties.

-

It is not needed for gifts.

Even when transferring ownership as a gift, a Bill of Sale can be beneficial. It serves as a record of the transaction and can help avoid disputes in the future.

-

Only the seller needs to sign it.

Both the buyer and the seller should sign the Bill of Sale. This ensures that both parties acknowledge the terms of the sale.

-

It must be completed before the sale takes place.

While it's often completed at the time of sale, a Bill of Sale can be filled out afterward. It's crucial to document the transaction as soon as possible to avoid any misunderstandings.

-

It is a government form.

A Bill of Sale is not a government-mandated document. It is a private agreement between the buyer and seller, and can be created using various templates or even handwritten.

Clarifying these misconceptions can help individuals navigate their transactions more effectively. Always consider consulting with a professional if you have questions or need assistance with the Bill of Sale process.

Documents used along the form

The South Dakota Bill of Sale form is a crucial document used in transactions involving the sale of personal property. However, several other forms and documents may be necessary to ensure a smooth and legally compliant transfer of ownership. Below is a list of commonly associated documents.

- Title Transfer Document: This document serves to officially transfer ownership of a vehicle or other titled property from the seller to the buyer. It typically includes details such as the vehicle identification number (VIN) and the names of both parties.

- Purchase Agreement: A purchase agreement outlines the terms of the sale, including the purchase price, payment method, and any conditions that must be met prior to the transfer. This document helps clarify the obligations of both parties.

- Odometer Disclosure Statement: Required for vehicle sales, this statement verifies the mileage of the vehicle at the time of sale. It protects both the buyer and seller from potential fraud regarding the vehicle's condition.

- Affidavit of Ownership: This sworn statement may be used to confirm the seller's ownership of the property being sold. It can be particularly useful when the original title is lost or unavailable.

- Bill of Sale for Trade-In: If a trade-in is involved in the transaction, this document records the details of the trade-in vehicle, including its condition and value, and is often used in conjunction with the primary Bill of Sale.

- Release of Liability: This form protects the seller from any future claims or liabilities related to the property once the sale is complete. It is important for the seller to have this document to avoid potential disputes.

- Sales Tax Exemption Certificate: This certificate may be necessary if the buyer qualifies for a sales tax exemption. It provides proof that the buyer is exempt from paying sales tax on the transaction.

- Ownership Transfer Certificate: This document provides formal recognition of the transfer, ensuring that both parties have a record of the change in ownership. For more information, you can refer to the Ownership Transfer Certificate.

- Power of Attorney: In cases where the seller cannot be present to complete the transaction, a power of attorney can authorize another individual to sign the Bill of Sale and other documents on their behalf.

Each of these documents plays a significant role in ensuring that the sale is conducted legally and that both parties are protected. It is advisable to review each document carefully and seek assistance if needed to facilitate a successful transaction.

Common mistakes

-

Incomplete Information: One common mistake is leaving out essential details. Buyers and sellers should ensure that all fields are filled out completely. This includes names, addresses, and descriptions of the item being sold. Missing information can lead to confusion or disputes later on.

-

Incorrect Dates: Failing to provide the correct date of the transaction can cause issues. It's important to note the date when the sale takes place, as this can affect warranties, registrations, and other legal aspects related to the sale.

-

Not Including Signatures: Both parties must sign the Bill of Sale for it to be valid. Sometimes, one party forgets to sign, which can invalidate the document. Ensuring that both the buyer and seller have signed is crucial for the transaction's legality.

-

Neglecting to Keep Copies: After completing the Bill of Sale, it's vital to keep a copy for personal records. Many people overlook this step. Having a copy can provide proof of the transaction in case any issues arise in the future.

Key takeaways

When dealing with the South Dakota Bill of Sale form, it’s important to understand several key aspects to ensure the document serves its purpose effectively. Here are some essential takeaways:

- The Bill of Sale serves as a legal document that records the transfer of ownership of personal property from one party to another.

- It should include detailed information about the item being sold, such as its make, model, year, and identification number, if applicable.

- Both the buyer and seller must provide their full names and addresses to establish clear identities.

- A date of sale should be included to indicate when the transaction took place.

- Consider including the purchase price to document the financial aspect of the sale.

- Both parties should sign the document to validate the transaction; signatures signify agreement to the terms outlined.

- Keep a copy of the Bill of Sale for your records, as it may be needed for future reference or legal purposes.

- Check local laws or regulations to ensure compliance, as specific requirements may vary by county or municipality.