Free South Dakota Articles of Incorporation Document

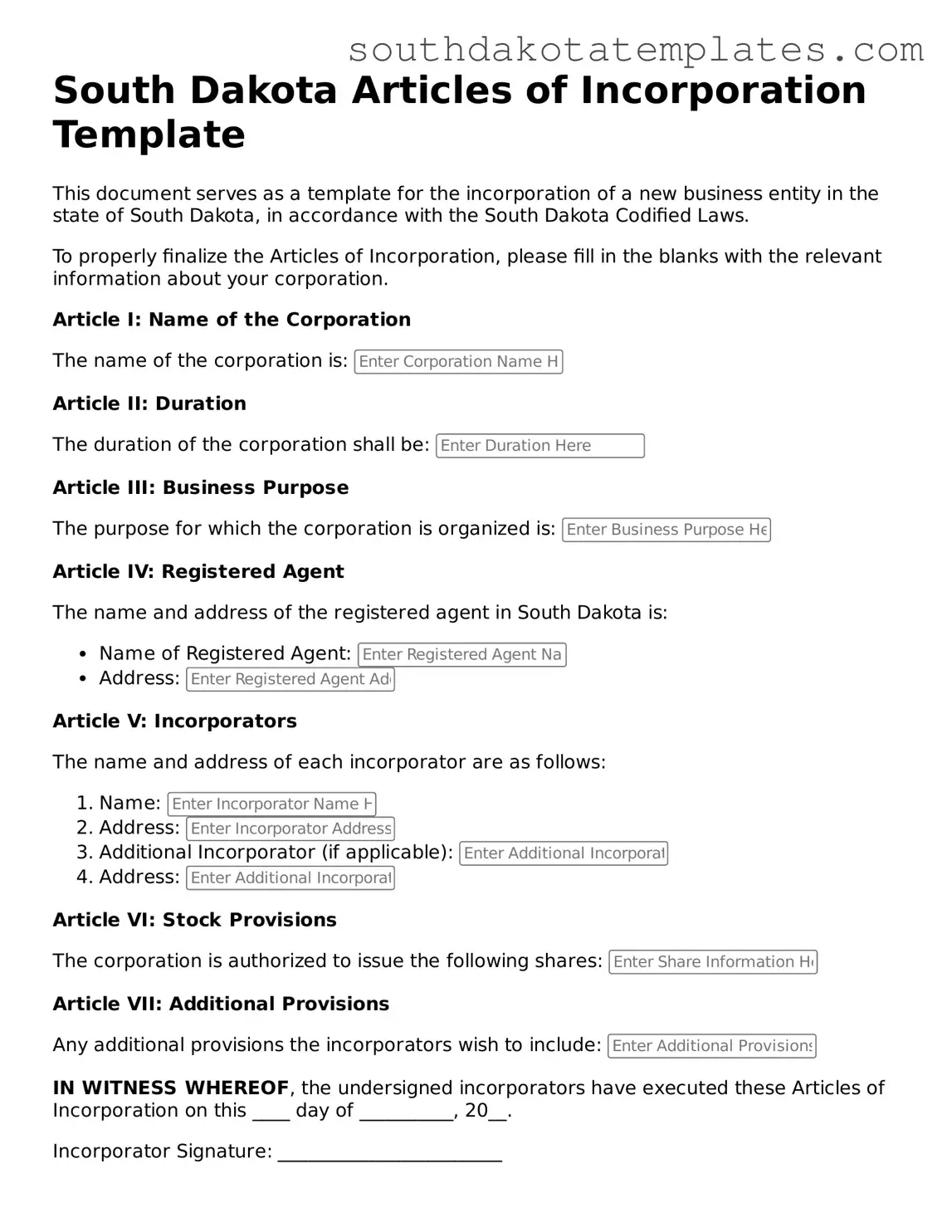

When establishing a business in South Dakota, one of the essential steps involves filing the Articles of Incorporation form. This document serves as a foundational legal instrument that outlines the basic structure and purpose of the corporation. Key elements of the form include the corporation's name, which must be unique and compliant with state regulations, as well as the designated registered agent who will receive legal documents on behalf of the corporation. Additionally, the form requires information about the corporation's duration, which can be perpetual or for a specified term, and the purpose of the business, detailing the activities the corporation intends to engage in. The Articles of Incorporation must also include the number of shares the corporation is authorized to issue, which is crucial for determining ownership and investment. Furthermore, the incorporators, who are responsible for filing the document, must provide their names and addresses. Collectively, these components ensure that the corporation is properly registered and recognized under South Dakota law, setting the stage for its legal existence and operational framework.

Fill out Other Popular Forms for South Dakota

Dmv Registration Sticker - Required for any formal sale or trade of an ATV.

For anyone looking to ensure a legitimate transaction, understanding the role of a comprehensive bill of sale document is crucial. This form is vital for recording ownership transfer and serves to protect both parties involved in the exchange. For more details, you can refer to this detailed bill of sale guideline.

South Dakota Rental Agreement - Details regarding television and internet services can be addressed in the lease.

File Specifics

| Fact Name | Details |

|---|---|

| Purpose | The South Dakota Articles of Incorporation form is used to legally establish a corporation in the state of South Dakota. |

| Governing Law | This form is governed by South Dakota Codified Laws, specifically Chapter 47-1A, which outlines the requirements for forming a corporation. |

| Filing Requirement | To complete the incorporation process, the Articles of Incorporation must be filed with the South Dakota Secretary of State. |

| Information Needed | The form requires basic information such as the corporation's name, registered agent, and the number of shares authorized for issuance. |

Guidelines on How to Fill Out South Dakota Articles of Incorporation

After completing the South Dakota Articles of Incorporation form, you will need to submit it to the appropriate state office along with any required fees. Make sure to keep a copy for your records. The following steps will guide you through filling out the form accurately.

- Start by entering the name of your corporation. Ensure that the name complies with South Dakota naming requirements.

- Provide the principal office address. This should be a physical address, not a P.O. Box.

- Indicate the purpose of your corporation. Be clear and concise in describing what your business will do.

- List the name and address of the registered agent. This person or business will receive legal documents on behalf of your corporation.

- Include the number of shares your corporation is authorized to issue. Specify the class of shares if applicable.

- Fill in the names and addresses of the incorporators. These are the individuals responsible for setting up the corporation.

- Provide the effective date of incorporation if you want it to be different from the filing date.

- Sign and date the form. Ensure that the signatures are from the incorporators listed.

Once you have completed these steps, review the form for accuracy before submission. This will help prevent any delays in the processing of your incorporation.

Misconceptions

Understanding the South Dakota Articles of Incorporation form is crucial for anyone looking to establish a corporation in the state. However, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- All corporations must have a physical office in South Dakota. This is not true. While a registered agent must have a physical address in South Dakota, the corporation itself does not need to maintain a physical office in the state.

- Filing the Articles of Incorporation is the only step needed to form a corporation. In reality, while this is a vital step, additional actions such as obtaining an Employer Identification Number (EIN) and complying with state regulations are also necessary.

- Anyone can serve as a registered agent. This is misleading. A registered agent must be a resident of South Dakota or a business entity authorized to conduct business in the state.

- There is no need for a corporate bylaws document. This is incorrect. Although not required to be filed with the state, bylaws are essential for outlining the internal governance of the corporation.

- All corporations must issue stock. This is a misconception. Non-stock corporations, such as certain nonprofit organizations, can be formed without issuing stock.

- The Articles of Incorporation can be filed at any time. While there is no strict deadline, it is advisable to file as soon as possible to ensure legal protection and compliance.

- Changing the Articles of Incorporation is a complicated process. While amendments do require filing, the process is straightforward and can often be completed without significant difficulty.

- Once filed, the Articles of Incorporation cannot be changed. This is false. Amendments can be made to the Articles of Incorporation as the corporation evolves or as necessary.

Clarifying these misconceptions can help streamline the incorporation process and ensure compliance with South Dakota law.

Documents used along the form

When forming a corporation in South Dakota, several documents may accompany the Articles of Incorporation. Each of these forms serves a specific purpose in the incorporation process. Below is a list of commonly used documents that can help ensure a smooth establishment of your business.

- Bylaws: These are the internal rules governing the corporation's operations. Bylaws outline the roles of officers, the process for holding meetings, and how decisions are made.

- Initial Report: This document provides essential information about the corporation, including its address and the names of its officers. It is often required shortly after incorporation.

- Operating Agreement: This essential document outlines the governance structure and operating guidelines for a Limited Liability Company (LLC), ensuring clarity in the rights and responsibilities of its members, along with financial and functional provisions for the business. For more information, visit TopTemplates.info.

- Registered Agent Consent: This form confirms that the registered agent has agreed to serve in that capacity. A registered agent is necessary for receiving legal documents on behalf of the corporation.

- Employer Identification Number (EIN) Application: This application is submitted to the IRS to obtain an EIN. This number is essential for tax purposes and hiring employees.

- Operating Agreement: Although more common in LLCs, this document can also be useful for corporations. It outlines the management structure and operating procedures.

- Stock Certificates: These documents represent ownership in the corporation. Issuing stock certificates is a way to formalize the ownership structure.

- Meeting Minutes: Keeping a record of decisions made during meetings is crucial. Minutes document what was discussed and the resolutions passed.

- Business License Application: Depending on the type of business, a license may be required to operate legally within the state or local jurisdiction.

- Annual Report: Many states require corporations to file an annual report. This document updates the state on the corporation's status and any changes in its structure or operations.

Understanding these documents can help you navigate the incorporation process more effectively. Each form plays a vital role in establishing and maintaining your corporation's legal standing and operational efficiency.

Common mistakes

-

Incorrect Name of the Corporation: One common mistake is failing to include the correct name of the corporation. The name must be unique and not too similar to existing businesses.

-

Missing Registered Agent Information: Every corporation needs a registered agent. People often forget to provide the name and address of this individual or business.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly stated. Vague or overly broad statements can lead to confusion.

-

Improper Number of Shares: When indicating the number of shares the corporation is authorized to issue, some individuals either leave this blank or enter an incorrect number.

-

Failure to Sign the Document: It may seem obvious, but some people forget to sign the Articles of Incorporation. A missing signature can delay the process.

-

Incorrect Filing Fee: Each filing requires a specific fee. Submitting the wrong amount can result in rejection of the application.

-

Not Following State-Specific Guidelines: South Dakota has its own rules for Articles of Incorporation. Ignoring these can lead to mistakes.

-

Omitting the Duration of the Corporation: Some forms require you to specify how long the corporation will exist. Failing to include this information can be problematic.

-

Not Keeping Copies: After submitting the Articles of Incorporation, it is essential to keep a copy for your records. Many forget this important step.

Key takeaways

Filling out the South Dakota Articles of Incorporation form is a crucial step for anyone looking to start a corporation in the state. Here are some key takeaways to consider:

- Provide Accurate Information: Ensure that all the details, such as the corporation's name and address, are correct. Any inaccuracies can delay the approval process.

- Designate a Registered Agent: You must appoint a registered agent who will receive legal documents on behalf of the corporation. This person or entity must have a physical address in South Dakota.

- File with the Secretary of State: Submit the completed Articles of Incorporation to the South Dakota Secretary of State. This can often be done online, by mail, or in person.

- Understand Filing Fees: Be aware of the fees associated with filing the Articles of Incorporation. These fees can vary, so check the current rates before submitting your form.